Gantry Cranes are as containers stacked below at Brani Terminal, managed by PSA (Port of Singapore Authority) International PTE, Singapore on 12 April. | Photocredit: Getty images

THe US is the largest champion of free trade and the most important architect of globalization since the mid -20th century. In a stunning reversal of roles, however, US President Donald Trump unleashed a carpet bomb attack on the global trading system on 2 April, which he explained as “Liberation Day”.

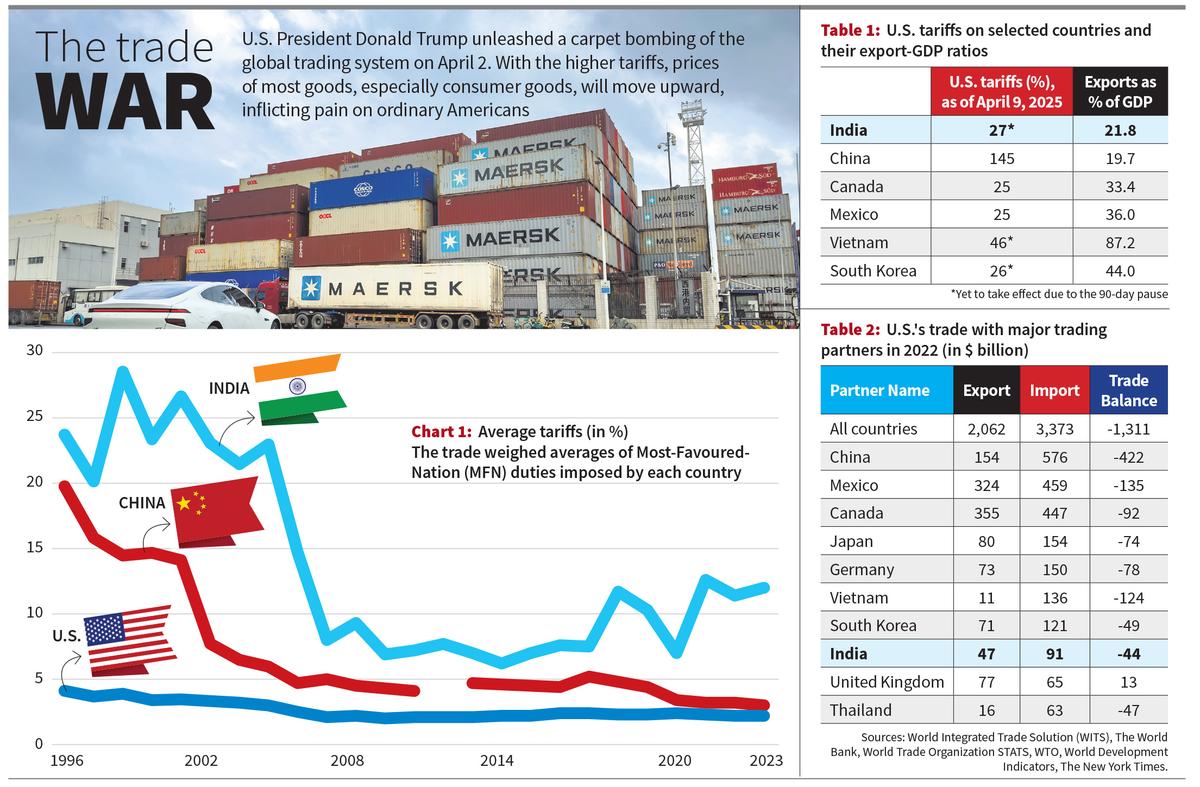

The American rate, or the Tax America taxes on import from other countries, was two to 3% until 2024 2 to 2024 (graph 1). President Trump, however, stated on 2 April that from now on the US would charge at least 10% rate for all its entry. Input from around 60 countries will have a considerably higher level rate-that will be described as “reciprocal” rates. These include rates of 20% on the European Union (EU), 27% on India and 46% on Vietnam.

Rates of 25% were imposed on Mexico and Canada, the neighbors of the US and two of the largest trading partners in February. But the biggest shock is the rate imposed on China, which delivers a sixth of all foreign goods that the US uses. The import from China to the US, from 11 April, will now be confronted with rates of 145% (Table 1).

The markets recess with horror over the scale of the rate increases and their uncertainty. Stock markets. China has taken revenge and has returned every tariff bladder with equal cruelty. It has imposed 125% rates on the entry from the US. There is a clear possibility that the US and the world are on its way to a painful economic recession. On April 9, President Trump reversed some of his decisions and announced a 90-day break about “mutual” rates for most countries, while he insisted that the steep rates for China would immediately be in force.

A raw material with a price tag of $ 100 imported from (say, Vietnam) would have cost $ 103 on the American market if the rates were 3%. However, the same good must be purchased for $ 146 when the newly announced rates come into force. Rates protect domestic industry against foreign competition, but can lead to price increases.

‘Make America great again’

With its high income per head of the population and low rates, the US is the largest export market for goods from cars to computers, which helps the production of production paths in different countries. In 2022, China exported goods worth $ 576 billion to the US, but in return the US could only sell $ 154 billion in goods to China (Table 2). In general, the US had a trade deficit of $ 1,311 billion, or 5% of its gross domestic product (GDP), in 2022. America managed to keep buying more of the world than what it sells because of the position of the dollar as the dominant international currency. This is mainly thanks to China, which continues to support through dollar-mixed assets, whereby important parts of its large export surpluses in American treasury bonds are stopped. Since the two largest economic powers, such a mutually affordable relationship has been the most important motivation of the globalization of trade and finance since the 1920s.

However, globalization creates inequalities, not only in the developing but also in the developed world. In the US, sectors such as steel and cars were among the most affected by import competition.

The resentment of the employees in these sectors of whom many were white men of middle-aged are one of the factors that Mr Trump helped in 2016 and again in 2024 to the US presidency to prop. President Trump has promised to breathe new life into the production of American production, to protect it against competitors who were allowed to drop “America” with their imports in previous years.

Without a doubt President Trump plays with fire. With the higher rates, the prices of most goods, in particular consumer goods, will go up and hurt ordinary Americans. It is doubtful whether American companies can cancel their production options in order to satisfy at least part of the demand for them by making Import more expensive.

China’s gamble

China has sworn “to fight to the end” in what can be a long -term and bitter trade war. Such bravoure is supported by the fact that China has been quietly preparing for such a confrontation for more than ten years, which gradually reduces dependence on the American economy. The Proportion of Exports to GDP has declined steeply in China, from 35% in 2012 to 19.7% in 2023. As a proportion of its total exports, China’s exports to the us have fallen, too, from 21% to 16.2% in 2022. particularly in Artificial Intelligence and Electric Cars. This was partially done in response to the limitations of the US on technology transfer to China. China bypassed American rates earlier by moving production to his East -Asian neighbors (especially Vietnam), with which the deep economic networks built.

The options of India

President Trump calls India a ‘rate king’, referring to the clear increase in India’s rates since 2018 (graph 1). The majority of India exports are sold to the US ($ 91 billion in 2022), and they are crucial for complying with the large import account of the country. That is why every reduction in India export income will be felt sharply after rate escalation. At the same time, since the export is a relatively small share (21.8%) of its GDP, the impact of the tariff increases can be less in India than in many other countries (Table 1). There is also no increase in rates for medicines and services, two of the most important export articles from India to the US

The novelty of the production possibilities is the biggest obstacle for India. Tarief protection and the production -connected incentive scheme have not been sufficient to breathe new life into this sector. India needs a clear industrial policy and a revival of investments to escape from the unfolding global unrest.

Jayan Jose Thomas is a professor of economics at the Indian Institute of Technology (IIT) Delhi.

Published – April 14, 2025 8:30 am