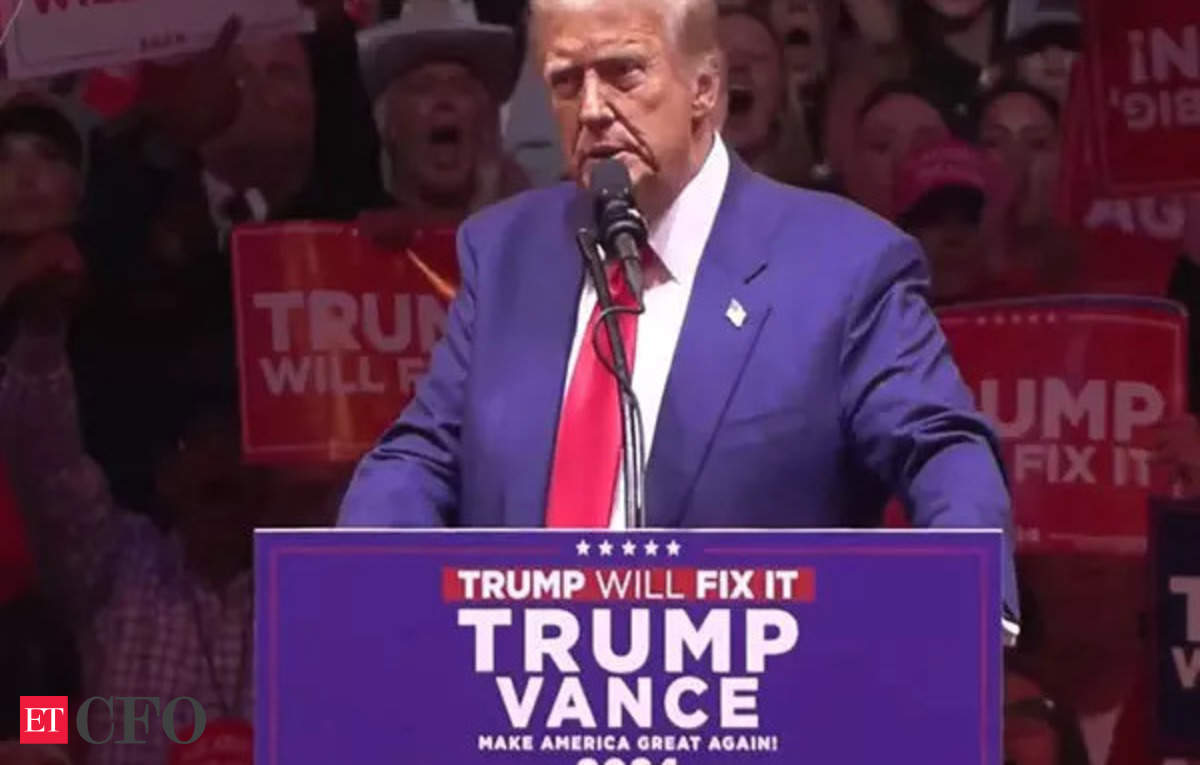

New Delhi [India]November 4 (ANI): A victory for Donald Trump in the upcoming US presidential election could lead to a stronger US dollar, a Barclays report said.

The report noted that in previous US presidential elections, such as in 2019, a possible Trump victory was also linked to expectations of a stronger dollar.

The report said: “A key difference this time compared to 2019 is that a potential Trump victory would likely imply a stronger USD. This would likely complicate the policy calculus for some – but importantly, not all – central banks in emerging Asia.”

According to the report, this expected strength of the dollar could influence the monetary policy strategies of some central banks, especially in emerging markets in Asia.

A rising dollar often poses challenges for emerging market economies such as India as it can increase the cost of imported goods and affect trade balances.

However, the report states that India’s central bank will prioritize internal economic conditions and the Reserve Bank of India is likely to continue with this approach regardless of external pressures.

The report predicts that the Reserve Bank of India (RBI) will continue to largely focus its attention on domestic economic factors rather than responding to global shifts.

It said, “As in 2019, we expect the Reserve Bank of India to continue to focus on domestic dynamics.”

The RBI’s low sensitivity to currency movements and its emphasis on supporting stable economic growth in India means that domestic issues, such as inflation control and economic recovery from the pandemic, are likely to take priority in its policy announcements and monetary management.

The report also highlighted that on the fiscal front, emerging Asian governments have generally been reluctant to use fiscal policy as a countercyclical response to rising trade tensions during Trump’s first presidency – even as spending rose for other reasons.

The US Federal Reserve will meet on Wednesday and Thursday to make important decisions on interest rate cuts.

The Fed meeting could trigger significant changes in US monetary policy, potentially impacting global financial markets. (ANI)