Just hours after Transrail Lighting started accepting bids on Thursday, Transrail Lighting’s IPO was fully subscribed, closing Day 2 on Friday with a 5.31x subscription.

The share allotted to retail retail investors (RIIs) saw a subscription rate of 6.90 times, while the non-institutional investor category saw 7.23 times subscription. The allocation for Qualified Institutional Buyers (QIBs) had a subscription level of 1.38 times.

The public offering for engineering and construction company Transrail Lighting began on Thursday, December 19, with a price range of ₹410-432 per share. This IPO, which will be completed on December 23, generated a profit ₹245.97 crore through its anchor book on December 18.

The IPO is valued at the highest point of the price range ₹839 crore, resulting in a market capitalization of approx ₹5,600 crore.

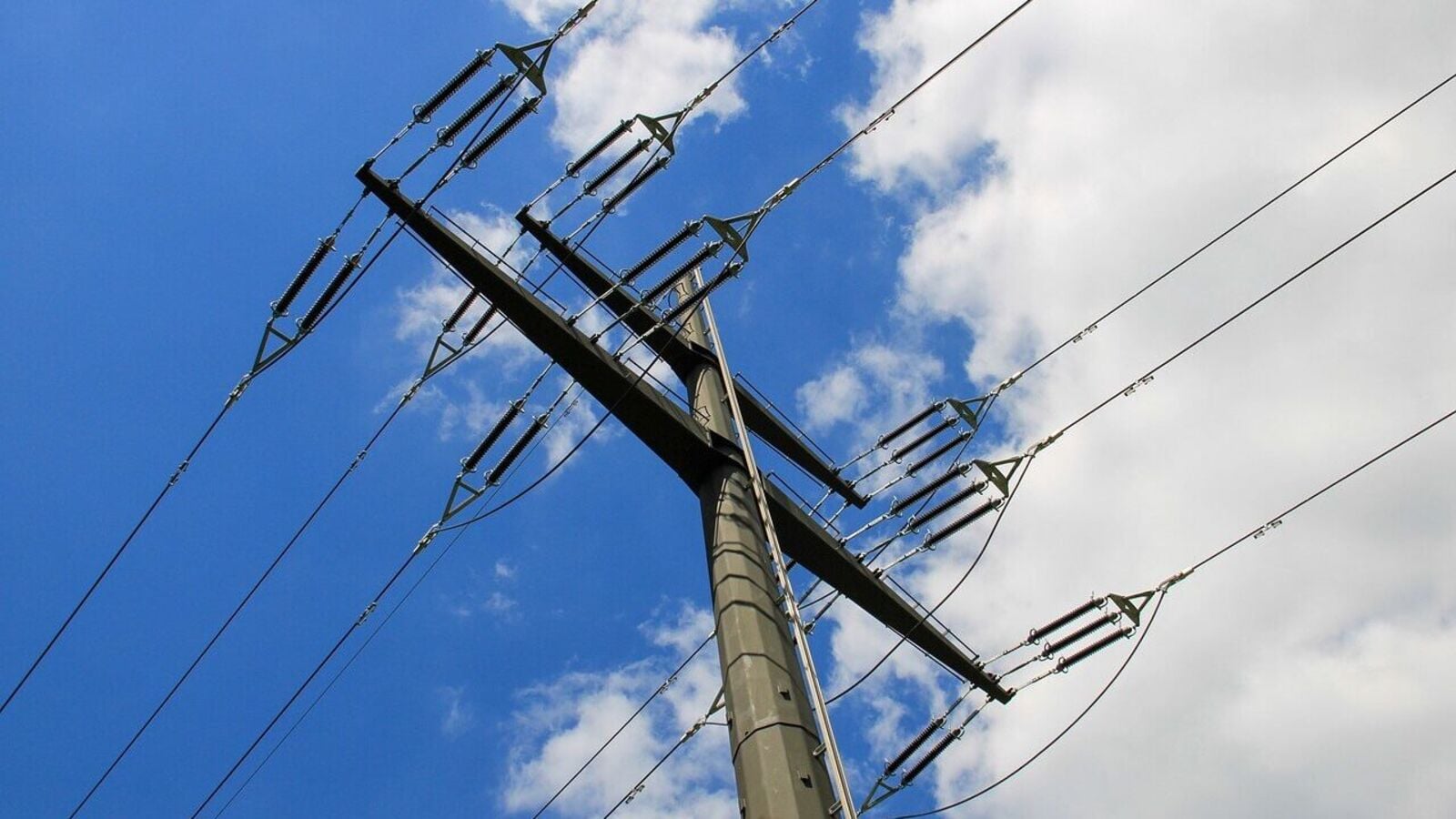

Transrail Lighting stands out as a leading EPC company in India, primarily focused on energy transmission and distribution. They also operate integrated production facilities for grid structures, conductors and monopoles. The GMP increased to ₹186 with an estimated loss price of ₹618, according to investorgain.com