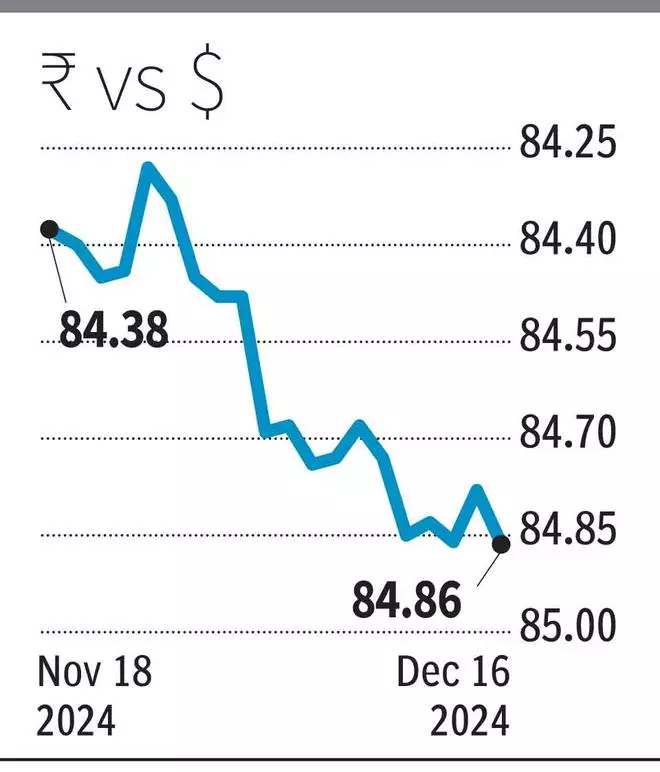

The rupee closed at an all-time low on Monday, influenced by a host of factors including a rise in US Treasury yields, a weak Chinese yuan, India’s trade deficit rising to a record high and a decline in domestic stock markets.

The rupee closed at 84.8625 per US dollar, down about 8 paise from the previous close of 84.7875.

Forex dealers say as long as US Treasury yields rise and the yuan weakens, the rupee will be under pressure.

India’s trade deficit hit a record high of $37.8 billion in November, up from $27.1 billion in October. A larger trade deficit has a weakening effect on the currency.

Amit Pabari, MD, CR Forex Advisors, noted that all eyes are on the Federal Reserve, with the CME FedWatch Tool indicating a 94 percent probability of a 25 basis point rate cut, fully achieving total rate cuts for the year. 1 percent.

However, the real attention will be on Fed Chairman Powell’s comments after the meeting. As Donald Trump prepares to take office in the White House next month, the potential impact of his tariff policies and broader economic agenda will undoubtedly influence market sentiment and weigh heavily on the dollar index.

“If Powell strikes a forgiving tone and signals a continuation of rapid interest rate cuts through 2025 – likely given the US’s significant government debt – this could put pressure on the dollar index. Over the medium term, the dollar index is expected to move towards the 103 level, while strong resistance emerges around 108. This shift would in turn provide much-needed support to emerging market currencies,” Pabari said.

Trade deficit

ICRA chief economist Aditi Nayar said India’s trade deficit widened amid a rise in gold imports to an unprecedented $14.9 billion in the month, as well as a relatively milder rise in other imports.

“Such high levels of gold imports were likely driven by festive and wedding-related demand and are unlikely to sustain in subsequent months, which would help cool coming trade deficits.

“Nonetheless, the unfavorable trade deficit for November will result in a sharper than expected increase in India’s current account deficit in the third quarter of FY2025, to 2.8 percent of GDP, against previous expectations of ~2.0 percent enter. be the highest in more than two years,” Nayar said.

ICRA has also revised its FY 2025 forecast for the CAD to ~1.4 percent of GDP from ~1.0 percent earlier.