Indian shares fell sharply on Monday due to weak global cues, declines in banking stocks and reports of the HMP virus outbreak.

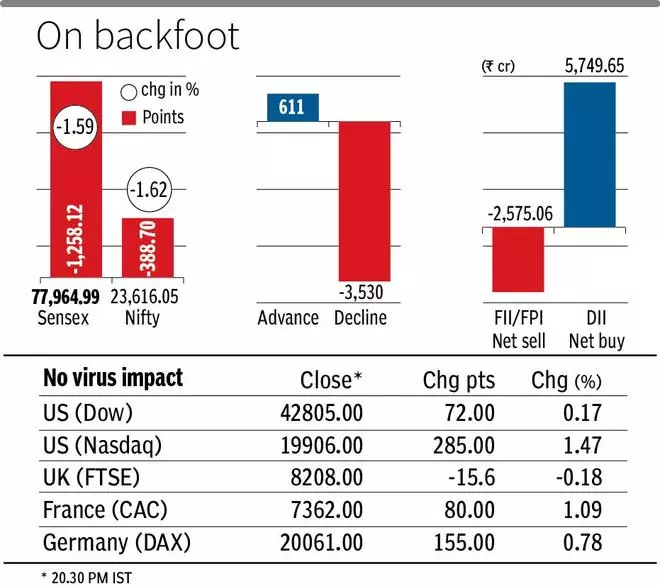

The Nifty 50 fell 1.6 percent to 23,616, while the Sensex tumbled 1.59 percent to 77,965. The Nifty Smallcap 100 index and Nifty Midcap 100 index fell 3.2 percent and 2.7 percent respectively. The number of declining stocks exceeded the number of advancing stocks, with the forward decline ratio on BSE standing at 0.19, the lowest since October 22.

Nifty PSU Bank, Oil & Gas, Realty and Metals indices were the biggest losers. Bank stocks were under significant pressure after the lackluster quarterly updates, with the Nifty Bank index down 2.1 percent to 49,922, while the Nifty Financial Services index lost 1.76 percent.

Vinod Nair, head of research at Geojit Financial Services, said emerging markets are undergoing consolidation due to uncertainties surrounding the new US economic policy, the Fed’s hawkish stance on future rate cuts, a possible upward revision in inflation in CY25, and a strong dollar.

-

Also read: ITC is trading without hotels at ₹455 each

“The main catalyst for a sharp sell-off in the domestic market appears to be HMPV concerns. The initial consensus earnings forecast for the third quarter suggests a possible gradual recovery in domestic corporate profits, which could explain the underperformance of the domestic market compared to global markets led by premium valuation,” Nair said.

The Indian rupee fell to an all-time low of 85.82, pressured by continued demand for the US dollar. On the domestic macro front, India’s services PMI rose to a four-month high of 59.3 in December from 58.4 in the previous month.

“We expect markets to remain volatile until concerns about the new virus subside. We could see stock/sector specific action on the back of the pre-quarter business updates and the start of the Q3 earnings season,” said Siddhartha Khemka, Head of Research, Wealth Management, Motilal Oswal Financial Services.

FPIs sold shares worth ₹2,575 on Monday, while domestic institutions bought shares worth ₹5,749 crore.

Asian stock markets traded mixed, with Japan’s Nikkei 225 and Indonesia’s Jakarta Composite the biggest losers.

“The short-term trend of Nifty is weak and you can expect more weakness in the coming sessions. The next lower supports are seen near the 23460 and 23260 levels. Any upward bounce could become a hurdle around 23800,” said Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities.