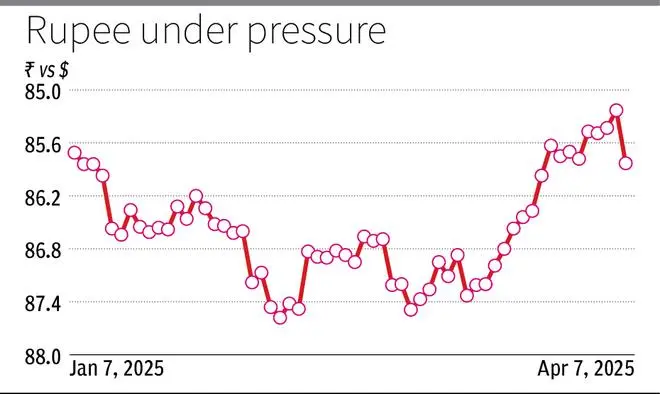

The rupid closed at 85,8350 per US dollar compared to the previous closure of 85,2350. | Photocredit: Leowolfert

The rupid dropped 60 Paise, the steepeste for a few days dropped in about three months, to end at a lowest point in two weeks, because the mutual rates of US President Donald Trump sang the global financial markets, including Indian Equity Markets.

The Indian unit came under pressure when FPIs press the sales button in the domestic stock markets amidst the sale on the worldwide markets. Foreign (guardian) banks have purchased dollars on behalf of FPIs for reviewing the sales proceeds.

What respite

Falling prices of crude oil and a weak dollar did little to support the rupid. The weakened because of the heavy dollar demand from FPI customers of foreign banks.

The rupid closed at 85,8350 per US dollar compared to the previous closure of 85,2350. The rupid opened 35 Paise on 85.59 and took instructions from the depreciation trend in the non -deliverable forward (NDF) market.

Arvind Kanagasabai, executive vice-president (treasury), Tamilnad Mercantile Bank, said: “When there is a huge crash in the market, money will go out by FPI outflows.

“All shares at the export -oriented companies have fallen today. This indicates that there will be a shortage in the inflow of dollars, even if the import will continue. So the general trade deficit will become larger. Market players would have started with coverage based on this assessment. That is why the rupid weakened.”

He noted that American importers will re -negotiate export contracts

Eyes fed

Sankar Chakraborti, MD & CEO, Acuité Ratings & Research, said that if the American Federal Reserve continues with rate reductions, this can illuminate the pressure on the rupee, giving the RBI more room for extra tariff reductions.

Sonal Badhan, economist, bank or Baroda, noted that the current year will probably be characterized by a period of volatility on the currency front, pending clarity on the American tariff policy. This will also form the stage for the tariff actions of the FED, in turn that influences how the dollar behaves.

Rupee is likely to find support in Domestic Front by improving growth opportunities, lower inflation and stable external shortages. In general, Bob’s Economics Department expects the rupid to act the reach of 85.5-87.5 in FY26.

More so

Published on April 7, 2025