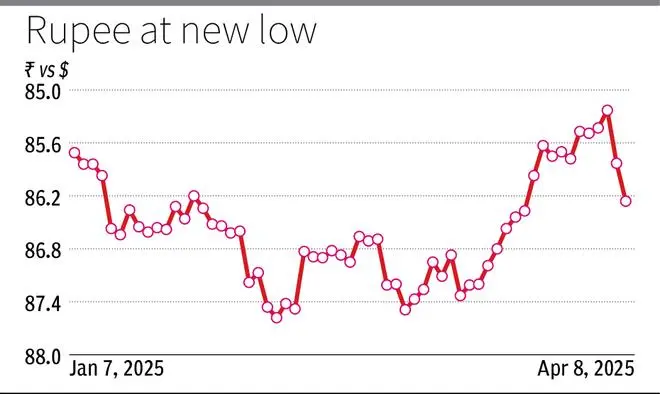

The rupee, which fell 60 Paise on Monday, closed at a lowest point of more than two weeks of 86,2650/dollars | Photocredit: Istockphoto

The Indian rupid was written off by 43 Paise, vaulted over the 86 to the dollar mark, in the midst of a strong dollar, which appreciated with rising American treasury yields, a weak Chinese currency and the hedge activity of importers.

The rupid, which fell 60 Paise on Monday, closed at a lowest point of more than two weeks of 86,2650/dollars compared to the previous closure of 85,8350, even when the stock market recovered about half the losses from the previous day. Intra-Day saw a low/high from 86.2925/85.8325.

Abhishek Goenka, founder and CEO, India Forex Advisors, noted that the weakness of the rupee came from the wide dollar strength, driven by rising American treasury rendments (2-year-old and 10-year revenues rose 22-24 basic points) and renewed trading sties of a 50 percent of Tarald Dondald a Tarald a Tarald a Tarald a Tarald a Tarald a Tarald a Tarald a Tarald A Tarald Tarald A Tarald A Tarald Tarald A Tarald Tarald Tarald A Tarald A Tarald Tame Import.

The global risk retirement remained fragile, in which the dollar/CNH (Chinese Yuan Offshore) pair tested the critical 7.35 resistance level, so that concern about possible overflow pressure on emerging market currencies such as the rupid was pronounced.

Bond yields rise

“In general, Indian shares recovered partly after volatile fluctuations, while the bond returns rose higher for the decision of the RBI policy. Market volatility accelerated, with 3 months atm (AT-the-Money) implicated volatility climbing of 40 bps to 4.44 percent, a reflection of increased uncertainty,” he said.

Goenka expects the rupid to retain a weakening bias, because cautious sentiment continues to exist in the midst of global trade risks and Yuan instability, aggravated by importers who accelerate hedge activities and speculation around China’s devaluation.

Madan Sabnavis, Chief Economist, Bank of Baroda, said: “The exchange rate cannot be taken for granted in both directions. FPI streams around the world have become nervous because the tariff roll has hit all nations and the stock markets have become nervous. This will have seen an important consideration as we Fy26”

Impact on sectors

Krisil ratings, in his ‘credit warning’, noted that the sharp volatility of rupee against the dollar in recent months in the background of continuous geopolitical uncertainties will dent the income of some sectors with a maximum of 250 basic points (BPS) in the fiscal year 2026.

The sectors include complex fertilizers, airlines, oil and gas (refining and marketing), polyvinyl chloride (PVC) pipes and fittings, capital goods, pharmaceutical products (active pharmaceutical ingredients or APIs) and renewable electricity.

Referring to an assessment by Crisil Intelligence (formerly Market Intelligence & Analytics), the report said that the rupid is expected to continue to write off against the dollar and settle at the end of FY26.

Published on April 8, 2025