Royalty payments by listed companies to their related parties, or RPs, have more than doubled in the past decade, according to a study by market regulator SEBI, signaling the need for stricter regulation.

Such payments rose 117 per cent to ₹10,779 crore in the ten financial years ended FY23. During the period, there were 1,538 instances of royalty payments within 5 percent of company turnover (without majority minority shareholder approval) by 233 publicly traded companies.

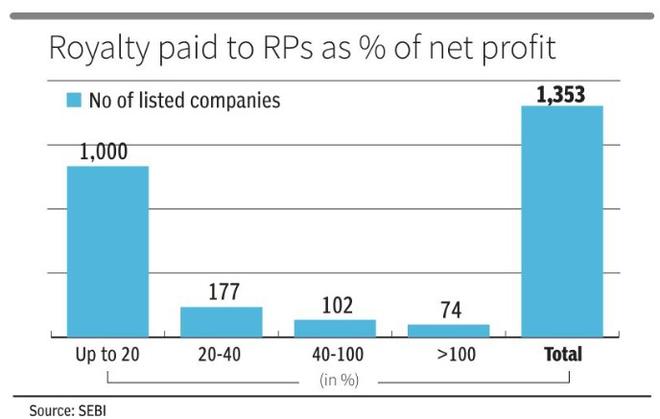

Of these, in 1,353 cases the payments came from listed companies that achieved net profits. In one in four cases, companies paid royalties to RPs that exceeded 20 percent of their net profits. One in two times, companies that paid royalties either paid no dividends or paid more royalties to RPs than to non-RP shareholders.

-

Also read: India to review royalty rates for offshore minerals ahead of landmark auctions

During FY 2014-23, there were 185 cases of royalty payments by 63 companies that suffered net losses. Such companies paid royalties of ₹1,355 crore to their RPs.

Seventy-nine companies consistently paid royalties to their RPs over the ten years examined. While total royalty payments by these companies kept pace with revenue and net profit growth through FY19, royalty payments declined after FY19. Eleven of the 79 companies consistently paid royalties of more than 20 percent of net profits over the past decade.

“The data suggests that while royalty payments by companies are reasonably within the established threshold (5 percent of sales), such payments are irresponsibly high in terms of their profitability,” the SEBI study said.

The regulator said companies are not providing appropriate information on the rationale and rate of royalty payments in their annual reports. The classification of royalty payments for brand use and technological know-how is not disclosed.

Problem faced

In the past, proxy advisory firms have identified several issues regarding royalty payments. For example, such payments have little correlation with companies’ revenues or profits. Companies sometimes request approval for perpetual royalty payments, which is contrary to corporate governance principles. In the case of multinationals, the shareholders of the Indian subsidiary have little information about the royalty rates charged in other regions.

According to SEBI, a broader policy discussion on some of the above issues may be needed. For example, could royalty payments be linked to a company’s profitability by introducing an appropriate threshold in terms of the net profit made by the company in previous years?