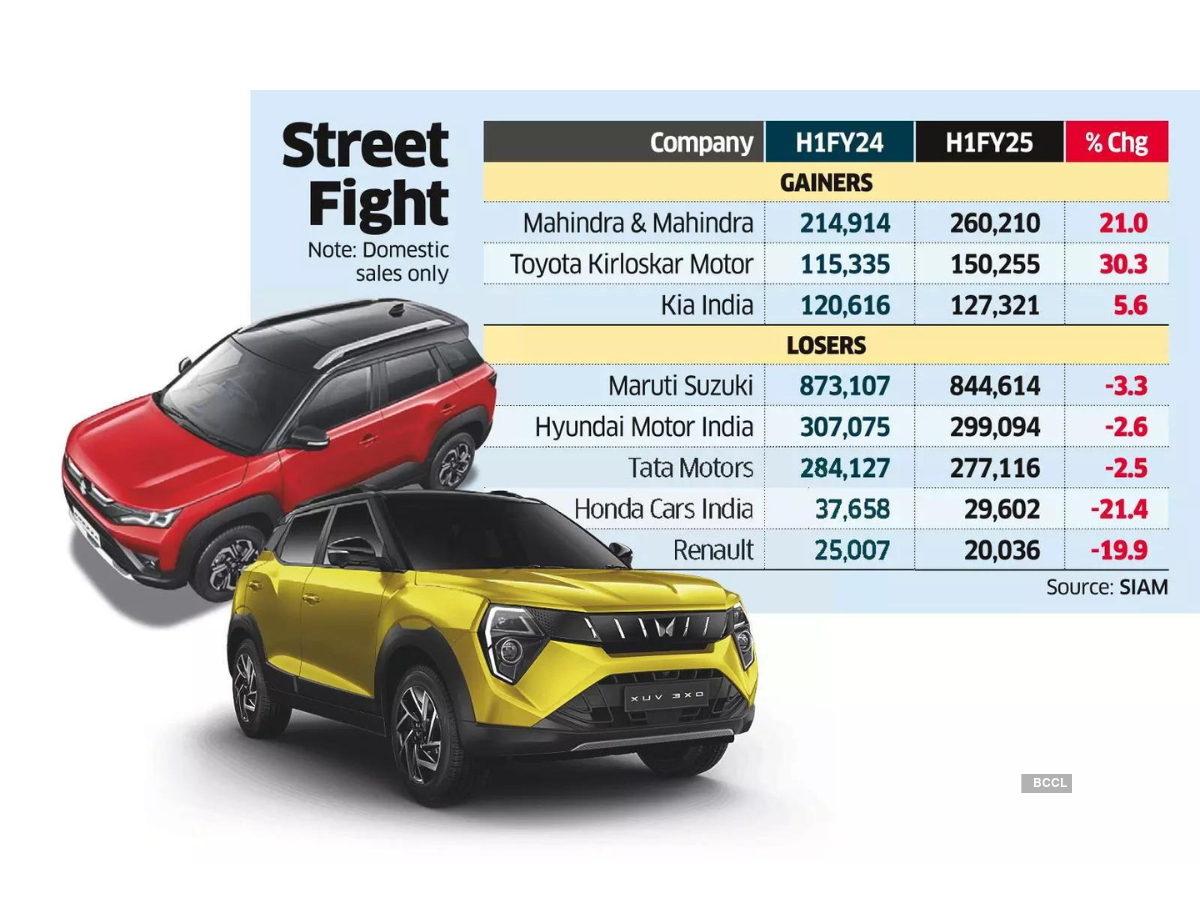

New Delhi: Only three of India’s 15 passenger car makers posted sales growth in the first half of this fiscal year, underscoring persistently weak consumer confidence and sluggish demand in the world’s third-largest auto market.

Mahindra & Mahindra (M&M), Toyota Kirloskar Motor and Kia India reported higher sales, while others, including the top three – Maruti Suzuki, Hyundai and Tata Motors, saw sales decline during the period.

Sales at Toyota Kirloskar – the maker of Fortuner and Innova Hycross models – grew by more than 31% – the fastest pace among carmakers, in a market where overall volumes increased by just 0.5%. M&M and Kia followed, with sales growth of 21% and 5.6% respectively, according to data from the Society of Indian Automobile Manufacturers (SIAM).

Toyota, Mahindra and Kia have expanded their presence with fresh produce in the country’s fast-growing commercial vehicle segment, helping them increase volumes.

Nalinikanth Gollaguna, CEO of M&M’s automotive division, said the company’s rugged SUV portfolio, recently supplemented by the XUV3X0 and the Thar Roxx, continues to be in high demand. He said the company is working to expand the capacity of its petrol, diesel and electric vehicles by 15,000 units per month by the end of the fiscal year.

However, the top three automakers – Maruti Suzuki, Hyundai and Tata Motors posted a sales decline of up to 3% in the six months ended September, driven by weak consumer sentiment, especially in the small car segment, where these companies also have a presence.

UV lamps continued to gain ground in the Indian market, with sales growing 13% to 1.34 million units in the first half of the financial year. Sales of hatchbacks and sedans fell by 18.5% to 660,098 units.

Rising UV sales have increased the vehicle category’s share of the domestic passenger car market to 65%, up nearly 8 percentage points from a year earlier.

“The PV market in India grew by more than 50% to 4.22 million units in FY24, compared to 2.77 million units five years ago. And if certain segments decline (increase) during this period, there must be structural shifts behind them. With rising disposable income and easy access to financing, younger customers can afford slightly more expensive models,” Shailesh Chandra, president of SIAM, told ET. There are also other buyers who prefer affordable micro SUVs or larger used cars. vehicles.

Hatchbacks and sedans represent only about 17% of total sales at Toyota, but their share is much higher at Maruti Suzuki, Hyundai and Tata, 51%, 32% and 23% respectively.

Hardeep Singh Brar, vice president and head (sales and marketing), Kia India said that the company has seen positive customer response to the new Sonet compact SUV. He said Kia’s rapid network expansion has also played a key role in growing volumes. The company has added more than 100 new dealers in more than 55 cities in eight months.

Sabari Manohar, Vice President (Sales, Service, Used Car Business) at Toyota Kirloskar said, “SUV and MUV segments continue to be our biggest contributor with models like Innova Crysta, Innova Hycross, Fortuner, Legender, Urban Cruiser Hyryder, Hilux and the LC-300 pumps up volumes.”

The rising sales numbers prompted Toyota to start a third shift at its factory, unlike some other automakers who are adjusting production to meet tepid demand.

Market leader Maruti Suzuki believes the setback in the small car market is temporary given India’s demographics. While demand for UV cars will continue to grow, the company says demand for small cars will revive once affordability improves for entry-level buyers. Hyundai and Renault also say that while the share of small cars has fallen in recent years, volumes are still significant, making a presence in the segment necessary.

“India is a growing economy, where the demand for transport will only increase. The crossover between traditional hatchbacks and micro SUVs is likely to increase, but the demand for entry-level cars will remain due to low vehicle penetration and our demographics,” said an industry expert, requesting anonymity.

As much as 65% of the country’s population is under the age of 35, a demographic group that economists and analysts predict will drive consumption across all sectors in the coming years. The International Monetary Fund (IMF) has predicted that India will become a $5 trillion economy with the third highest GDP by 2028.