The stock market naturally rewards patience about impulsive reactions and transfers wealth from those who chase short -term movements to those who are committed to a long -term strategy. This principle is mainly relevant today, because the BSE Sensex, which in September 2024 rose to around 85,800, has since fallen to almost 73,100.

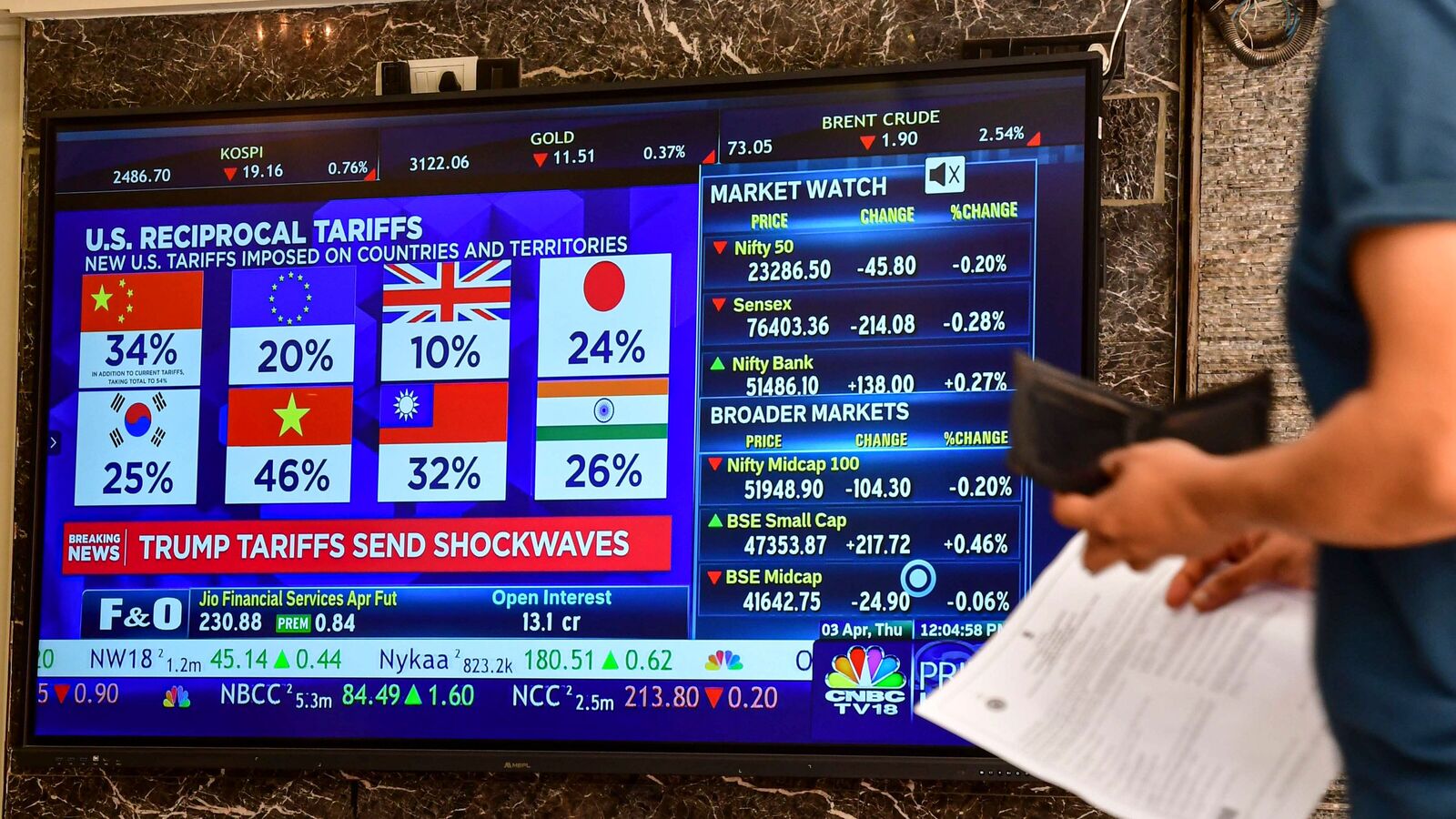

This decline reflects global trade conflicts, rising geopolitical tensions and capital outflows driven by a stronger US dollar, leading to short -term volatility.

Investment about protectionist policy in the US and fluctuations in global interest rates have kept investors sharp. Despite positive domestic indicators such as resilient GDP growth and the relaxation of inflation, worldwide headwind have overshadowed this profit, which contributes to the recent struggles of the market.

Stay the course

The structural growth engines of India remain intact. The nation sees a respectable strong expansion of capital expenditures, which stimulates employment and production in industries such as power, car and telecommunication. The rapid digital transformation and a rising middle class, an estimated one third of the 1.4 billion population of the country, play a crucial role in stimulating consumption.

In recent months there has been a serious sale in the market. The median price-to-win from BSE500 voters have fallen from 44x in September 2024 to 32x in February 2025. Historically, Markt Disciplined investors offered opportunities to collect high-quality assets in attractive valuations.

Although volatility can be disturbing in the short term, the markets tend to expand over time, driven by economic progress and innovation. With proactive government initiatives and a rapidly evolving digital economy, the current correction presents a crucial window for strategic, targeted investment decisions.

For an investor with a 15-year-old horizon, a market for the market is not just a phase to endure it is an opportunity. A decrease in portfolio value with 15-20% may seem alarming, but it also means that high-quality assets are now available with more attractive valuations.

By continuing to invest systematically and commit themselves to their goals, long -term investors can benefit from these lower prices, which determines the stage for considerable future profits when the markets return.

On the other hand, for someone who is approaching in the coming years in the coming years, a similar recession underlines the importance of coordinating investments with financial timelines to strengthen why target-based investing is essential for the management of risks and maintaining growth.

Relieve portfolios

As the market conditions evolve and the sentiment of investors shifts, there will be potential growth opportunities in the next phase of the cycle. This transition is a crucial window for investors to reinruit their portfolios, so that they are placed to take advantage of future growth while they are committed to their long -term financial goals.

Balance portfolio to a new balance ensures that investments remain in accordance with the long-term objectives, especially during volatile periods. During market dips this may mean that exposure to undervalued shares is increased while retaining adequate diversification to manage the risk.

Increasing contributions through SIPs (systematic investment plans) during market reduction can help decline with the average of the rupid and also positions investors to take advantage of the final recovery.

Investors must focus on structuring their portfolios on specific objectives – whether it concerns financial independence, maintaining asset retention or pension planning. Ensuring sufficient liquidity for short -term needs is just as important, because having a well -maintained emergency fund and assigning assets to liquid instruments can prevent the need for forced recording.

Understanding someone’s risk is just as critical. Market -NEWS often offers the possibility to collect assets at lower valuations, but the strategy must be adapted to the ability of an investor to withstand fluctuations. Those with a higher risk tolerance can increase exposure to shares, while conservative investors can look for a balanced approach with diversified asset spreads.

The key to financial success is not in predicting short -term movements, but in investing, after a structured plan and maintaining discipline. The key is to concentrate on financial goals instead of responding to short -term market sound.

Investing without a plan is when entering a flight without destination – turbulence will feel a lot worse.

Tarun Birani is the founder and CEO of TBNG Capital Advisors