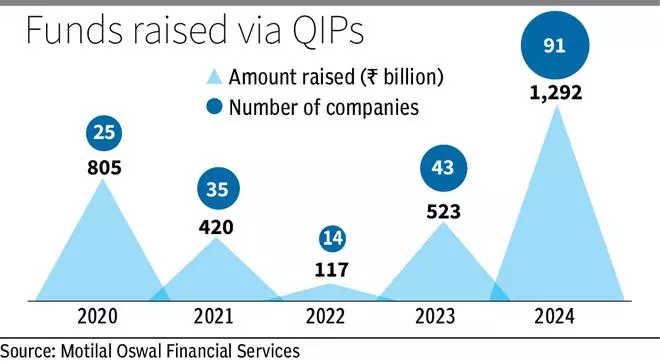

Ninety-one companies have raised ₹1.29 lakh crore through qualified institutional placements (QIPs) this year, a record for any calendar year. This is 2.5 times the amount raised in CY23 and 1.6 times the amount raised in CY20, the previous best cleanup.

According to a report by Motilal Oswal Financial Services, the top 10 companies have contributed about half of the total QIP amount raised this year. Major issues include Vedanta (₹8,500 crore), Zomato (₹8,500 crore), Adani Energy Solution (₹8,373 crore), Varun Beverages (₹7,500 crore), Godrej Properties (₹6,000 crore), PNB (₹5,000 crore ), Prestige estates (₹5,000 crore), JSW Energy (₹5,000 crore), Samvardhana Motherson (₹4,938 crore) and Adani Enterprises (₹4,200 crore).

The year was dominated by the real estate, utilities, auto, metals and PSU banking sectors, which collectively accounted for 57 percent of the total QIP issuances so far.

Capital boost

QIPs are a bull market product and are typically used to raise new capital for expansion or to pay down debt. Banks often use QIPs to shore up capital, while infrastructure companies use it to raise money to finance their growing order books.

Such placements are also a sign of confidence among the promoters to raise capital for expansion, diversification and for setting up new factories and machinery.

Positive return

More than two-thirds of the shares have delivered positive returns compared to their issue prices. Of the 91 issues, six have generated a return of more than 100 percent above the issue price. The top performers were Shakti Pumps (380 percent), Wockhardt (186 percent), Anant Raj (171 percent), eMudhra (133 percent) and Ganesha Ecosphere (127 percent).

Twenty-six shares trade at a discount to their issue price. The best performers include Vikas Lifecare (down 32 percent), Valor Estate (30 percent), Zodiac Energy (18 percent), Adani Energy (17 percent) and Jupiter Wagons (17 percent).