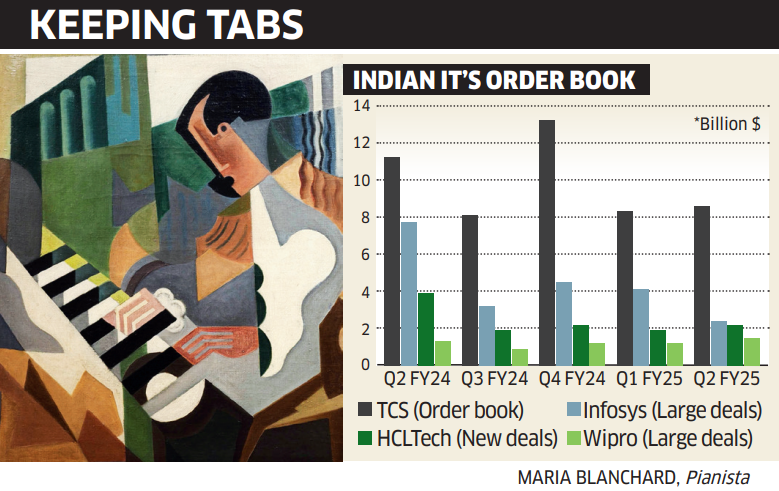

Although there were no mega deal announcements in the just ended quarter, Indian IT companies leveraged their partnerships with top clients to put up a strong show. From generating revenue from additional requirements from existing customers and restarting customers’ backlog projects to acquiring top clients, IT companies have been executing these incremental works with finesse.

Top IT companies saw the contribution of their top customers to their total revenue increase in the second quarter. HCLTech’s 20 largest customers, which contributed 27.3% of revenue in the second quarter of the last fiscal year, now contribute 350 basis points (100 basis points is 1%) more (at 30.8%). Infosys’ top 10 customers are contributing 100 basis points more today than what they contributed in the corresponding period last year. Similarly, Wipro’s top 10 customers are contributing 230 basis points more today (up from 22.9%) than what they contributed in the corresponding period last year (20.6%).

C Vijayakumar, CEO of HCLTech, said during a Q2 earnings call that the company has a lot of existing customers and that “it’s actually additional demand that comes based on the rate cuts.”

CEO of India’s largest IT company, TCS, K Krithivasan said the optimism stems from the backlog of work, “which some of our customers have not been able to continue due to the current environment they are in.”

Echoing similar sentiments, Peter Bendor-Samuel, CEO of consultancy and research firm Everest Group, said the acceleration of small deals is driven by several factors. “The first is the need to unlock value from existing digital investments. These initial investments were often made before and during the corona crisis and now companies are looking to extract more value from these investments, which will require further investments, but on a smaller scale.

“A second factor is continued caution regarding the macroeconomic situation and that is why companies are making smaller bets that equate to smaller deals,” said Peter.

Infosys CEO Salil Parekh also noted during the second-quarter earnings call that smaller deals, which doubled in the second quarter, were “a bit additive.”

In a recent interaction with ET, Nitin Rakesh, CEO and MD of Mphasis, noted that customers whose programs are currently underway are ready to fund the next phase of the programs and are ready to complete that next phase within six to 12 months to complete.

Mega deals are becoming increasingly extensive

Top IT executives like Krithivasan and Parekh felt that the total contract value (TCV) of large and mega deals is increasing. Analysts said this means there could be a lull for one or two quarters, and a blitzkrieg of deal announcements by the IT companies in the next quarter.

Pareekh Jain, CEO of EIIRTrend, a tech insights platform, said closing mega and large deals takes time due to the long sales cycle in this uncertain macro situation.

“The uncertainty also has more to do with the fact that customer commitment to long-term or high-value deals is becoming increasingly risky with the advent of AI maturity and the trend of insourcing.”