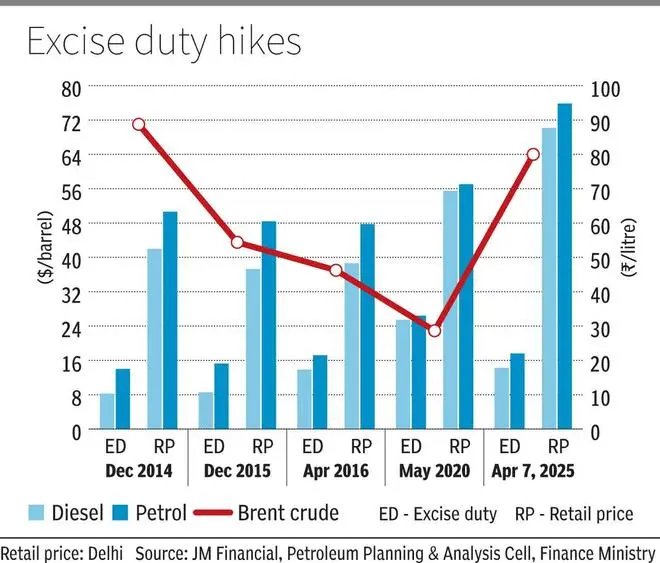

The preference of the government for increasing excise duties in times of low global prices for crude oil has been in practice since 2014, a mechanism that has been used more than a dozen times to increase income.

A back of the calculation of the envelope shows that between 2014 and 2025 the excise duty was revised about 16 times, the speeds of which were raised by about 13 times, while they were cut three times.

The highest number of revisions took place between 2014 and 2016, when the duty was revised nine times, while the rates were once lowered.

The government earned around £ 20,000 crore in FY15 and around £ 16,500 crore in FY16 of the overhaul.

Duty strategy

The excise duty of the center on gasoline and diesel has four components – bed, special extra excise duty (SAED), agricultural infrastructure and development of COSS (AIDC) and road and infrastructure movement or extra excise duty.

While part of the money that is collected through bed goes to Divisible Pools, which is distributed over states, money goes through the other three to the Kitty of the center.

In various cases, the government emphasized that the revision of excise duties is rates for generating finances for infrastructure and other development works.

On December 6, 2021, for example, a question was raised in Lok Sabha on the government that earned around £ 36,000 crore through excise response facilities in the previous 7 years.

State Minister of Finance Pankaj Chaudhary said: “Excise rates on gasoline and diesel are calibrated to generate resources for infrastructure and other development articles that hold the prevailing tax situation.”

In the past 6-7 years, the government has revised the rates of Saed, AED, etc., the proceeds of which rest entirely at the center. The upward revision of Monday in Saed will probably stimulate the Kitty of the Center by around £ 32,000 crore.

In addition, the £ 50 per cylinder increase of the LPG rates will probably yield around £ 5,000-7,000 crore for the OMCs.

To finance LPGs

The oil ministery said the yield will be used to reduce losses of PSU OMCs that provide LPG at affordable rates despite high Saudi CP prices that rose 63 percent between July 2023 and February 2025.

However, the oil ministers expect to compensate OMCs in FY26, which are saddled with losses of £ 41,383 Crore from FY25.

In 2022, the government gave £ 22,000 crore to PSU OMCs as a one -off subsidy for losses in Supply LPG against the market rates against losses of £ 28,000 crore.

According to the FY26 budget, the center expects to collect £ 3.17 Lakh Crore through excise duties.

Of which, more than £ 39,000 crore will come through bed, while more than £ 1.44 Lakh Crore, £ 47,000 crore and £ 57,000 crore have to be collected via Saed, AIDC and Road & Infrastructure Cess respectively.

Since the introduction of GST, almost the entire excise duty of the Union has been collected by means of crude oil and petroleum products, the collections can be attributed to crude, gasoline, diesel and other petroleum products.

Moreover, it will also help to compensate for loss of excise income in FY25. The estimate of the budget of excise collection was £ 1.22 Lakh Crore, while the revised estimate was £ 1.15 Lakh Crore.

Published on April 8, 2025