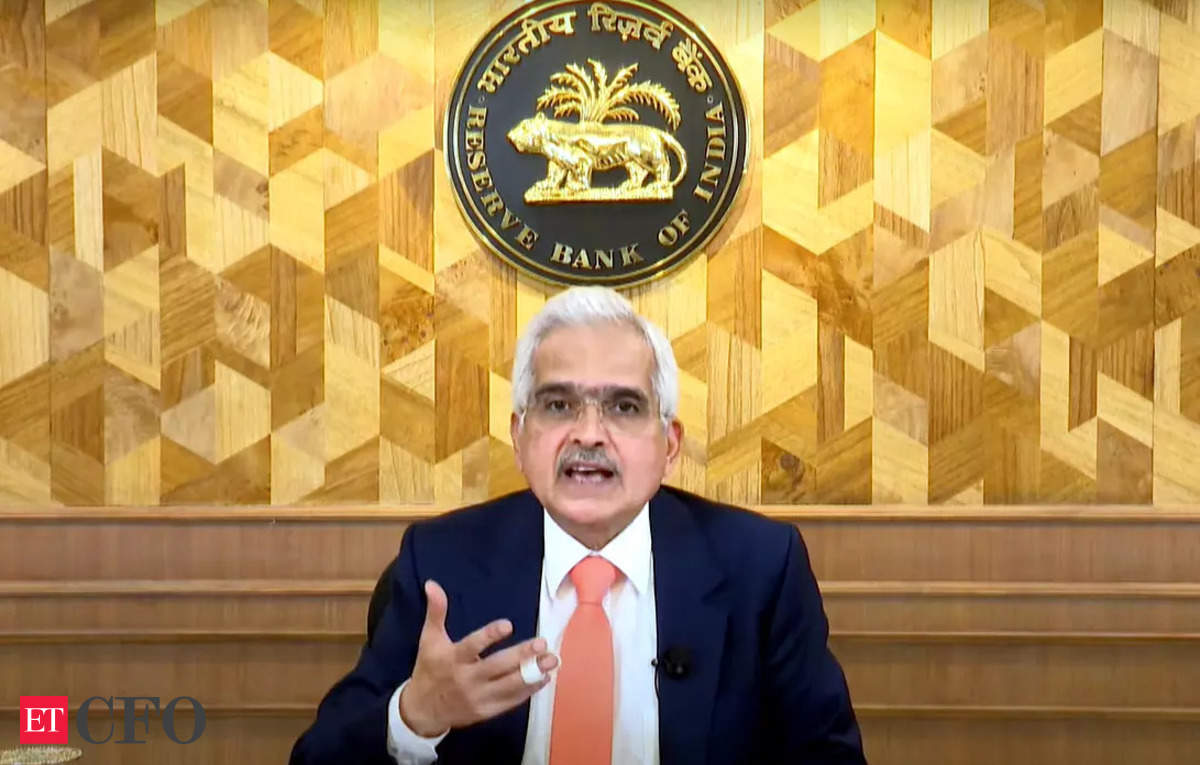

Reserve Bank of India (RBI) Governor Shaktikanta Das, while addressing the Macro Week 2024 event in Washington, called on global organizations such as the World Bank and the International Monetary Fund (IMF) to play a prominent role in decision-making processes for emerging economies.

Da pointed out that institutions such as the International Monetary Fund (IMF) and the World Bank need to increase access to resources and give emerging economies a more prominent role in decision-making processes.

He said: “Better access to resources and a stronger role in the governance of institutions such as the International Monetary Fund (IMF) and the World Bank will not only increase the legitimacy of these institutions but also promote more serious global cooperation in tackling macro-financial challenges. “.

While commenting on the need for reforms in the international financial system, he emphasized the need to address the challenges facing emerging economies and adapt to the evolving global economic landscape.

Stressing the importance of reforms, Das stated: “The first and foremost priority must be given to reforming the international financial architecture. This means prioritizing inclusive global governance frameworks that better reflect the realities of today’s global economy.”

He added that “the current system, while fundamental, must reform itself to ensure fair voice and representation for emerging economies.”

Increasing vulnerabilities for markets:

The RBI Governor also expressed concerns about the structural weaknesses of the global monetary and financial systems, noting that recent events have exposed vulnerabilities affecting both advanced and emerging markets.

He stressed the urgent need for better global financial regulation to manage the risks of private capital flows and the growing influence of non-bank financial intermediaries.

“There is indeed an urgent need to improve global financial regulation to manage the systemic risks posed by private capital and non-bank financial intermediaries, which now hold significant portions of global assets,” he stated.

Das also warned of the potential risks posed by the rise of shadow banking, fintech and decentralized finance, which have increased the complexity of global finance. He called for a stronger regulatory framework to avoid potential contagion effects, emphasizing that financial stability should be considered a “global public good.”

Addressing the impact of geopolitical tensions on global economic policy, Das noted that actions such as sanctions, trade restrictions and supply chain disruptions are driving economic fragmentation. He recognized the need for countries to secure supply chains in key sectors such as energy and strategic materials.

However, he called for cooperation, stating: “The G20 must play a key role in preventing further economic fractures by promoting open and rules-based trading systems.” He encouraged cooperation in areas such as technology transfer, investment in global public goods and promoting the green transition.

Governor Das also emphasized the crucial role of the G20 in promoting unity and preventing further economic divisions, suggesting that inclusive and balanced reforms in the international financial architecture are essential for global stability.

(with ANI inputs)