Shares of Hyundai Motor India Ltd fell nearly 6% early in their debut in Mumbai, a tepid start to trading for what was the country’s largest-ever initial public offering.

The shares traded at just Rs 1,844.65 after being priced at Rs 1,960, the top of the market. South Korea’s Hyundai Motor Co sold a 17.5% stake in its local unit in its initial public offering, seeking to capitalize on the investor frenzy for share sales in India – one of the world’s most vibrant locations for listings this year.

Hyundai Motor India, the country’s second-largest automaker by revenue, was valued at about $19 billion at its IPO. Some viewed the shares as pricey, with Bloomberg Intelligence analyst Joanna Chen noting that the valuation was about five times that of its Korean parent, although in line with Indian peers such as Maruti Suzuki India Ltd.

Although the offering was ultimately more than twice oversubscribed, the bookbuilding process was slower than some expected. Hyundai’s deal saw strong demand from institutions, which poured in on the final day of sales. However, private investors only bought about half of the share reserved for them in the IPO.

Individual traders felt ripped off as the parent company got all the proceeds from the IPO and demand cooled in the Indian auto industry, analysts said. The lack of retail interest is in stark contrast to the frenzy seen in some recent IPOs, particularly smaller issues.

‘Long term value’

Hyundai’s initial decline makes it an outlier as enthusiasm for Indian stock sales tends to feed into post-listing performance. New listings in the country have risen an average of 39% on their first day of trading this year, according to Bloomberg data. Among IPOs over $500 million, the average gain was 66%.

Some analysts are bullish on the stock’s long-term prospects.

“Hyundai Motor India’s IPO offers potential long-term value but is not suitable for investors looking for quick profits,” Devi Subhakesan, analyst at Investory Pte, wrote in a note on Smartkarma ahead of the debut. “Valuation risks are expected” against the backdrop of changing consumer preferences and increasing competition in the Indian auto industry.

India’s emergence as the world’s fastest-growing major economy and growing middle class provide opportunities for automakers. The country’s auto market is on track to reach 20 million units by 2047, said Kenichi Ayukawa, executive vice president of Suzuki Motor Corp. in an interview in July. A total of 4.2 million passenger vehicles were sold in India in the fiscal year ended March, according to the Society of Indian Automobile Manufacturers.

Nomura Holdings Inc initiated coverage with a buy rating ahead of the listing, citing expectations for “healthy” volume growth and vehicle price increases. It set a price target of Rs 2,472, implying a potential upside of around 26% over the IPO price.

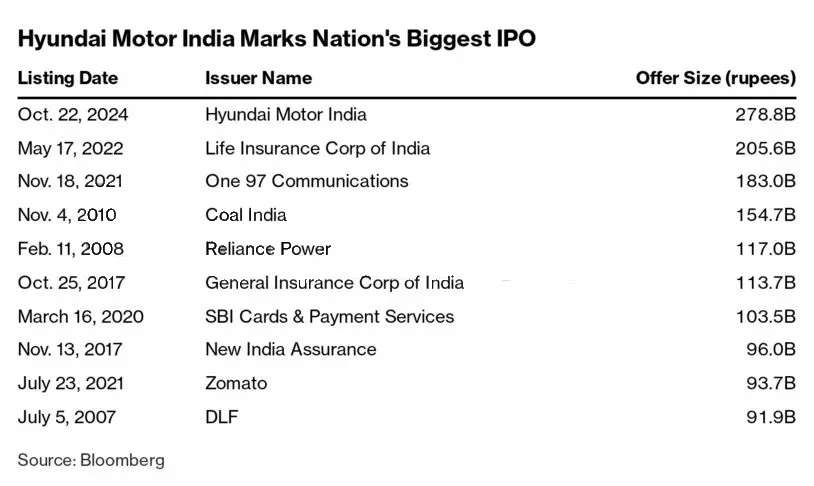

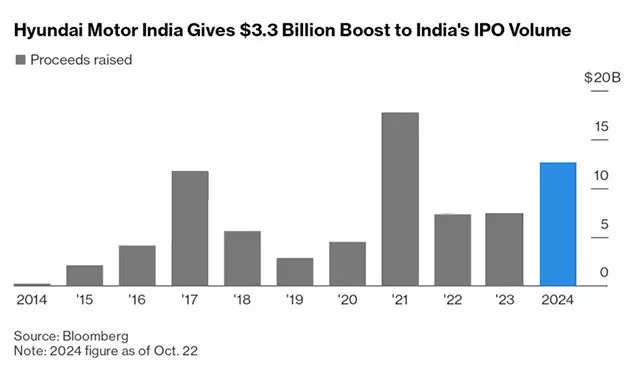

With Hyundai’s proceeds, Indian IPOs have raised more than $12 billion so far this year, surpassing the volumes of the past two years but still below the record $17.8 billion raised in 2021, according to data collected by Bloomberg. Other upcoming debuts include food delivery company Swiggy Ltd. and the renewable energy arm of state-owned energy producer NTPC Ltd.

About two dozen Asia-Pacific companies are listing shares this week in deals that could raise more than $8 billion, the biggest weekly volume since April 2022, according to data compiled by Bloomberg. Shares of Japan’s Tokyo Metro Co are expected to start trading on Wednesday following a $2.3 billion offering.