Faced with the rapid proliferation of digital technologies and an ever-expanding millennial/Gen Z customer base, major banks in the US and Europe have downsized their physical branch networks over the past decade. While the underlying thought process influenced strategic thinking globally, Indian banks bucked the trend. Instead, they focused on expanding their branches, resulting in one of the best growth periods for the Indian banking industry as a whole.

Now, US banks such as JP Morgan Chase and Bank of America have outlined their plans to open 500 and 165 new branches respectively over the next two to three years, underscoring the need for a physical branch network to meet the world’s banking needs. typical retail customer.

Personal touch

Research shows that while 70% of consumers are open to purchasing through digital channels, only 23% fulfill their financial needs digitally. When it comes to matters related to finance and wealth management, clients look forward to real interactions with their financial advisors before reaching a final decision.

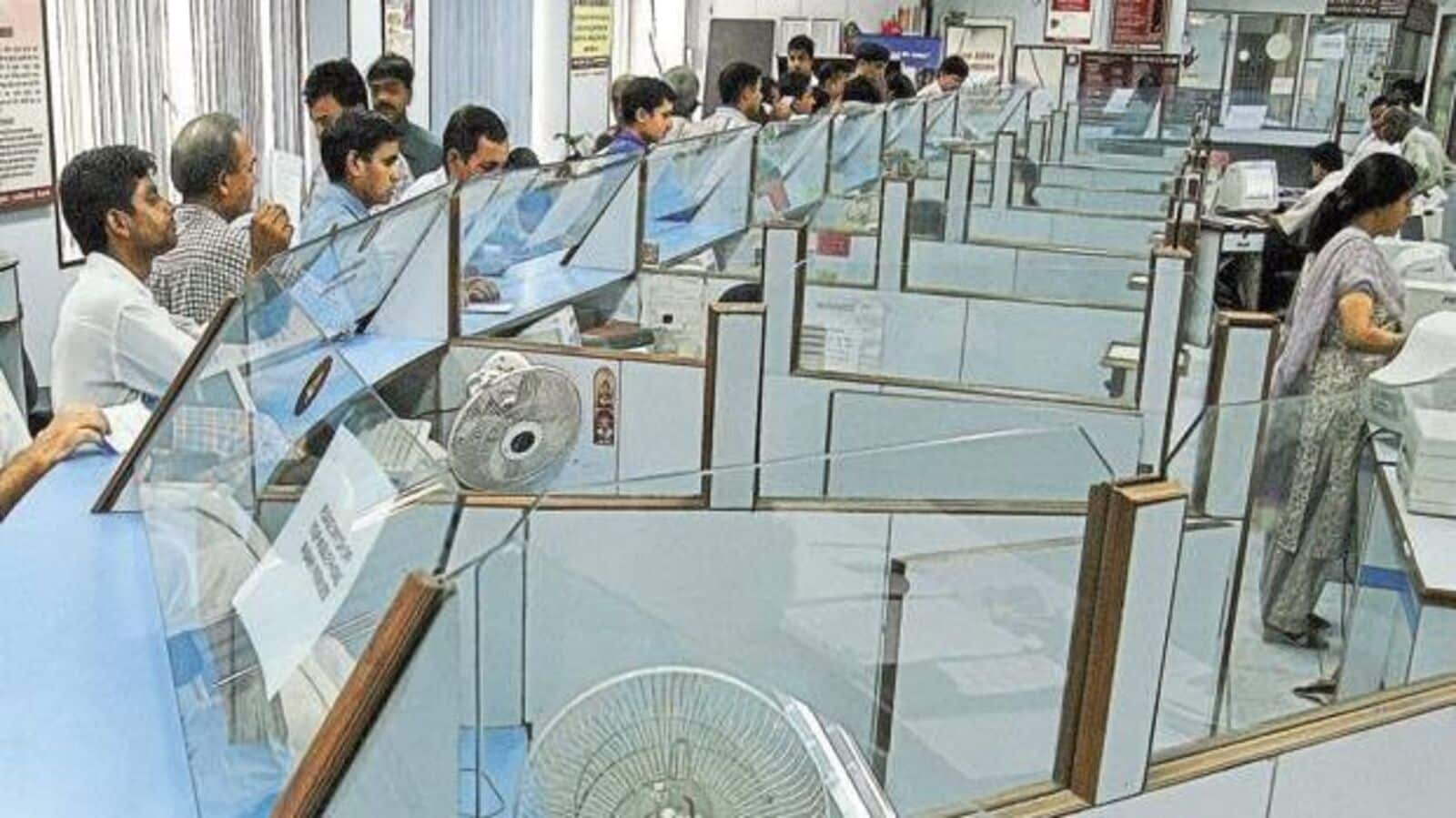

Physical branches provide the space needed for such face-to-face consultations and offer customers access to expert staff who can provide personal advice. This is more challenging to achieve through digital banking channels. Furthermore, online communication is counterintuitive when customers are faced with an abundance of complex choices. This is especially true when addressing customer-specific issues, where branch staff are more successful in resolving issues effectively while maintaining the highest customer satisfaction and loyalty standards.

While digital banking will continue to gain traction in the near future, traditional bank branches will evolve into ‘phygital’ branches – where physical and digital experiences come together to create seamless banking solutions.

Business expansion

While digital disruption has made the brick-and-mortar model extinct or nearly extinct in multiple domains, industries such as banking, education and healthcare have instead used digital technologies and analytics to improve the customer experience and unlock further operational efficiencies.

Aspects such as trust, human involvement and relationship management remain indispensable and non-negotiable in such sectors. This explains the need for more branch expansion to serve existing and new customers when it comes to retail banking activities. This in turn has allowed banks to capture a greater share of available revenue, as new customers rely on human contact and personal assistance when making important savings and credit-related decisions.

This is also known as the network effect in banking parlance and has meant that banks with a larger number of physical branches have been able to benefit from a proportionately larger share of the available business. In an era where retail banking is increasingly dominated by digital transactions, the traditional brick-and-mortar model remains relevant for both banks and their customers.

Technology integration

To facilitate this transformation, banks are introducing interactive kiosks, augmented reality displays and advanced AI systems into their physical branches. This type of technology integration not only provides customers with personalized advice, but also ensures an intuitive transaction experience during every visit. Branch staff will focus on providing relevant information to make informed decisions and work on building relationships rather than just completing transactions.

As a result, banks are already redesigning their branch layouts to facilitate such interactions, with most banks redesigning their internal processes and outdated organizational structures to achieve this goal. The ‘phygital’ banking model will therefore continue to evolve in line with advances in digital technology, with banks working to improve return on assets (RoA) by operating bank branches as individual profit centres.

Since 80-95% of the current retail banking business in India is contributed by physical branches, banks will need to continuously upgrade their branch network to maintain a strong brand presence and meet the ever-changing needs of customers. Achieving this while promoting trust and loyalty will become paramount in the near future as banks innovate new methods of integrating technology with human interaction.

Opinions are personal. Dheeraj Sanghi is a national head and a prosperous banker. Yes bank.