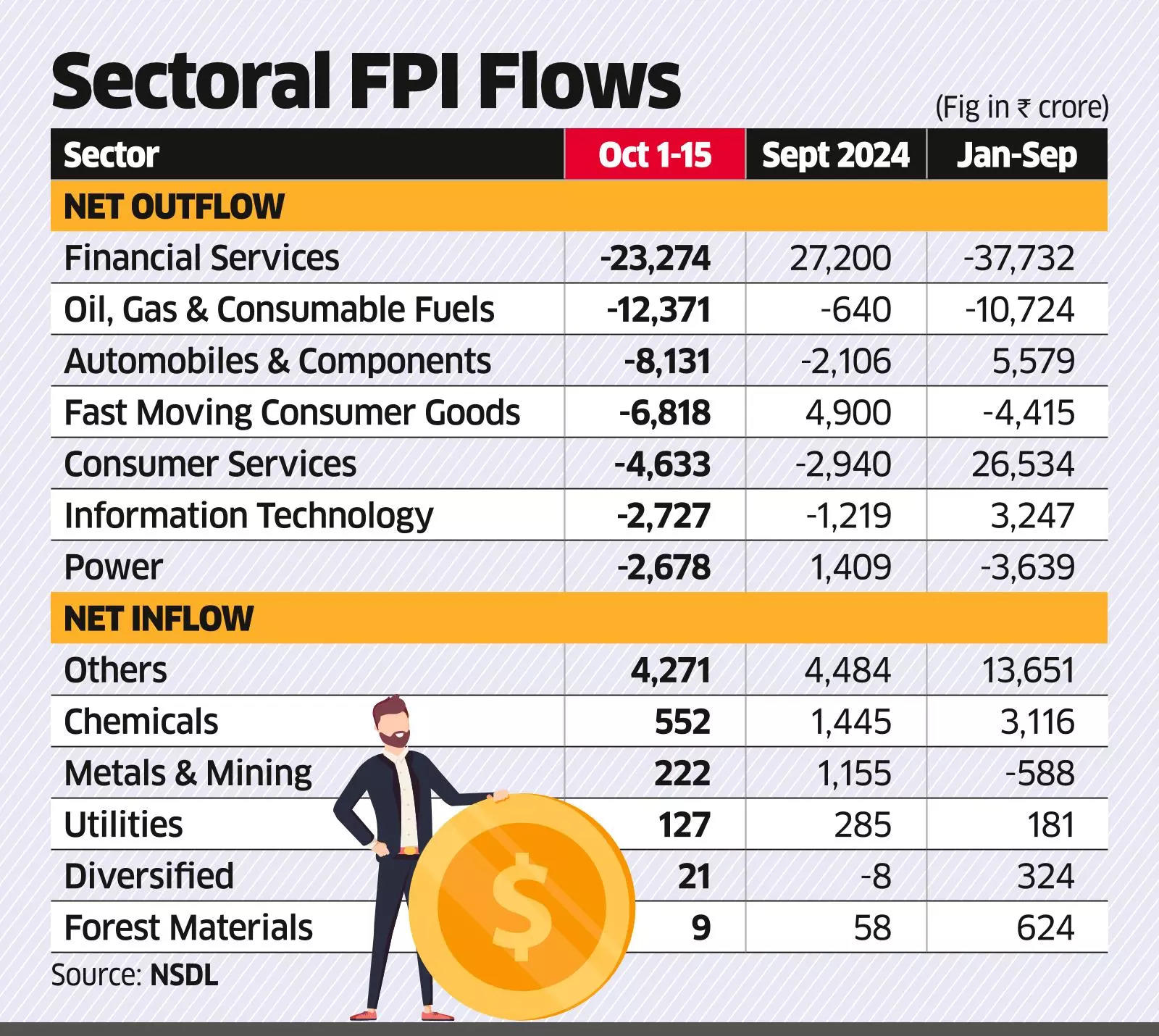

Mumbai: Foreign investors sold Indian stocks worth ₹71,502 crore across 17 sectors in the first 15 days of October, according to NSDL data.

Financial services bore the brunt of the overseas selling, with investors pulling out ₹23,274 crore from these stocks after buying a similar amount in September. From January to September, foreign investors sold ₹37,732 crore in the sector.

With financial services accounting for a large portion of the Nifty 50’s weight (33%), shares of sectoral players are the most sold by foreign portfolio investors (FPIs) when there is a risk-off sentiment.

“The fact that second quarter financial services results could be under pressure due to the battle for deposits and increased competition would also have weighed on the minds of the FPIs,” said Dhiraj Relli, CEO of HDFC Securities.

Bank Nifty fell 3.2% in the past month, while the benchmark Nifty 50 tumbled 3.6% in the same period.

“Foreign investors have a huge exposure to the financial sector and this time they have sold into different baskets. However, the sector has witnessed a similar amount of inflows in September, indicating that they may have tightened their recent positions,” said Hemant Nahata, co-director of the US financial sector. leading strategy at Yes Securities.

Foreign investors have pulled out ₹77,000 crore from Indian equities so far this month (on October 18) – their highest single-month turnover in recent years – as a recovery in Chinese equities has reduced their interest in local equities.

The oil and gas and energy sectors were the other themes that witnessed higher foreign outflows during this period. While oil and gas stocks sold for ₹12,371 crore, mainly due to the surge in crude oil which rose to $81.13 per barrel earlier this month due to the conflict in West Asia, energy sector stocks were witnessed an outflow of ₹2,678 crore.

“Apart from being a heavyweight in the benchmark index, Reliance is also a heavyweight in the oil and gas sector as FPIs do not have major stakes in the other PSU names,” Nahata said. “The recent selling in the oil and gas sector could be largely due to the selling of FPIs in Reliance Industries.”

The relentless foreign selling extended to defensive sectors such as fast-moving consumer goods (FMCG) and healthcare, which had received foreign inflows in September. Foreign investors raised shares worth ₹6,818 crore from FMCG stocks and ₹2,376 crore from healthcare stocks in the first half of October.

As sentiment towards Indian markets has turned slightly negative on the FPI side due to valuation concerns, they have been aggressive sellers, Relli said.

“So even defensive sectors like healthcare and FMCG are under selling pressure as their valuations are still on the higher side,” he said.

Construction, telecommunication and building materials were among the sectors that saw a trend reversal, with foreign investors selling sales worth over ₹1,000 crore in the first half of October.

Foreign investors invested ₹5,202 crore in six sectors in the first half of the month. The sector classified as ‘others’ received the highest inflows worth ₹4,271 crore, while chemicals and metals and mining received ₹552 crore and ₹222 crore respectively.

“FPIs still have large holdings in Indian equities and further selling cannot be ruled out, albeit at a slower pace, as markets have corrected,” Nahata said.

“Sales in India were initially driven by the trade-off between China and India, but the disappointing earnings figures of consumer-based names further dampen sentiment.”

Relli said that since sales are specific to the Indian market, all sectors could face selling pressure relative to FPI holdings. However, sectors such as IT, energy and real estate could see lower selling pressure than others.