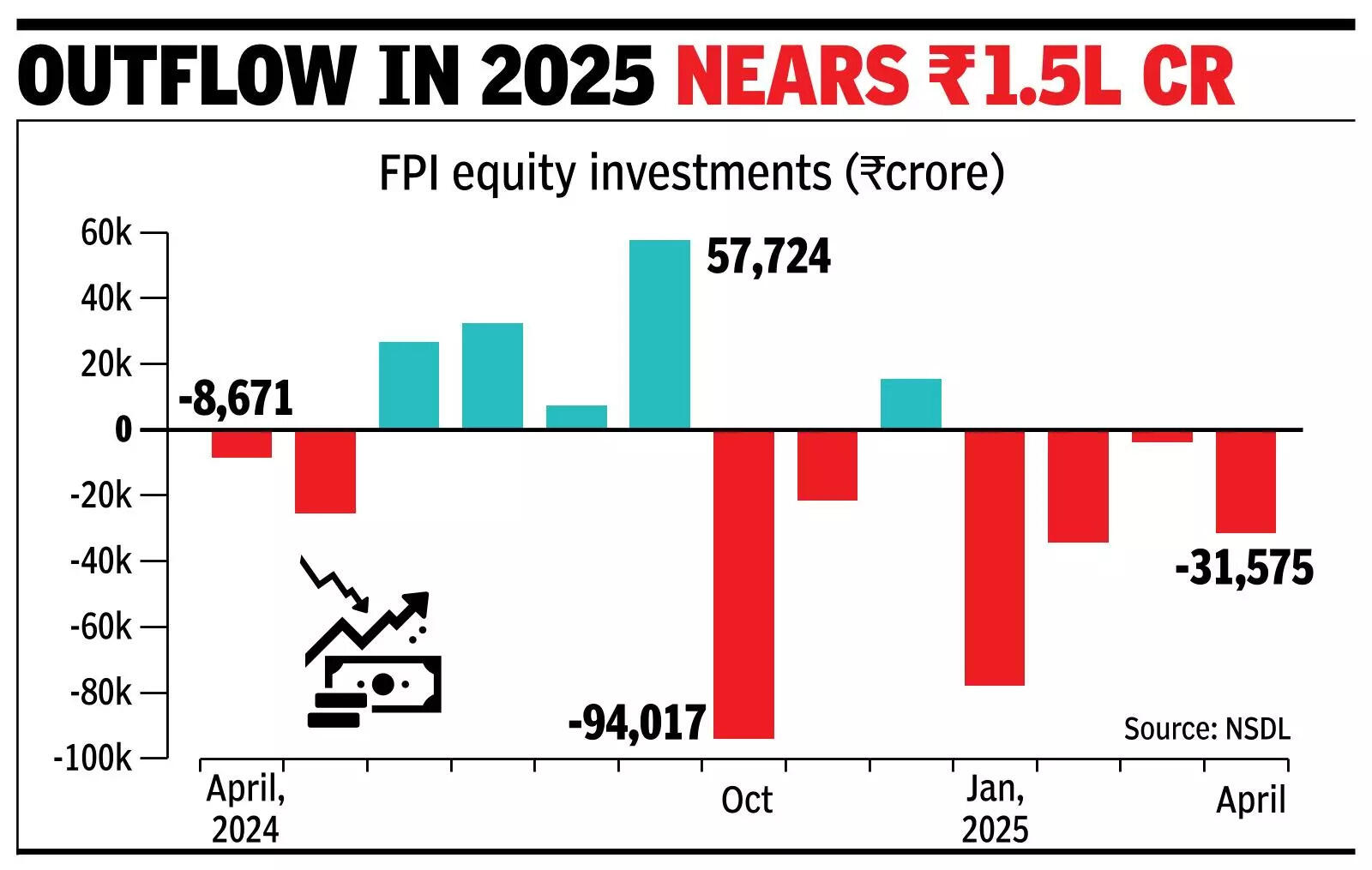

New Delhi: Foreign Investors have so far removed RS 31,575 Crore from the country’s stock markets, in the aftermath of turbulence that comes from major rates imposed by the US in most countries, including India.

This was after a net investment of RS 30,927 Crore in the six trade sessions from March 21 to March 28. This infusion helped to reduce the total outflow for March to RS 3,973 Crore, according to data from the depositors.

Compared to previous months, this is a remarkable improvement. In February, foreign portfolio investors (FPIs) worked out 34,574 crore, while in Jan the outflow was even higher at RS 78,027 Crore. This shift in investor sentiment emphasized volatility and evolving dynamics in global financial markets.

According to the data, FPIs RS received 31,575 Crore from Indian shares between April 1 and April 11.

With this, the total outflow by FPIs has so far reached almost RS 1.5 Lakh Crore in 2025. “The turbulence on global stock markets after the mutual rates of President Trump has also influenced FPI investments in India,” Vk Ingayakums, Chief Investment, said.

He believes that a clear pattern in the FPI strategy will only arise after the current chaos has been issued. “In the medium term, FPIs are likely to change buyers in India, because both the US and China are on their way to an inevitable delay due to the running trade war. Even in an unfavorable worldwide scenario, India can grow by 6% by 6% in FY26. This, together with a better profit growth in Fy26, can be in the Fy26, canceling in the Fy26, canceling in the Fy26, in witheric, in witheric, in witheric, in witheric,” has added. agencies