Consumer companies in India that make everything from soap to cars are sounding the alarm as the urban middle class continues to cut spending for at least the second consecutive quarter, while inflation and unemployment weigh on sentiment.

At least seven of India’s largest companies, including RIL’s retail arm and consumer supplier Hindustan Unilever, have indicated weaker consumer demand and a challenging business environment in their earnings results for the July to September quarter.

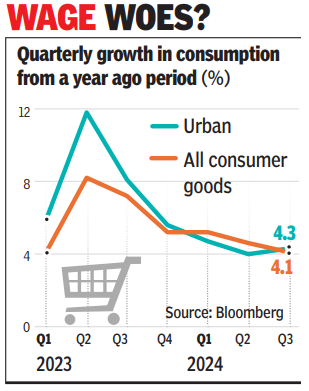

As the post-pandemic euphoria fades, higher interest rates, subdued wage growth and poor employment prospects are negatively impacting urban demand. While India’s rural consumers are showing signs of spending more thanks to a good monsoon season that has boosted rural incomes, this cannot make up for the decline among the nearly 500 million urban residents.

The fault lines in India’s consumption story do not bode well for the global giants that rely on India’s 1.4 billion strong consumer base to fuel growth amid an economic slowdown in China. Sales from operations of Reliance’s retail unit, India’s largest retailer, fell 3.5% in the quarter ended September 30 – a decline partly attributed to weak demand for fashion and lifestyle products.

A revival of rural demand, however welcome, cannot compensate for the shortfall in massive urban spending. For Unilever’s India unit, smaller cities and towns account for just a third of sales, CFO Ritesh Tiwari told reporters last week. A recovery in demand growth would happen within a few quarters, he said. “The pattern is quite clear that urban growth has declined over the last few quarters,” HUL CEO Rohit Jawa said after the maker of Dove soaps and Magnum ice creams posted sluggish profits.

The slowdown is now feeding into India’s growth forecasts, although the country’s central bank has shown no sign of giving in to calls for rate cuts.

“Underlying demand conditions are wait-and-see,” India’s finance ministry said in a report on Monday. The softening consumer sentiment indicated a moderation in urban consumption, according to the report. The slowdown is across all sectors: Passenger car sales fell for two months in a row in September, while air travel has fallen for three out of four months since June. Factory activity in India has been declining since July, although an increase was recorded this month.

“Companies are cutting payroll expenses,” wrote Sonal Varma and Aurodeep Nandi, economists at Nomura Holdings Inc. in an Oct. 28 report. Companies are reducing their payroll costs due to a combination of weaker nominal salary growth and a leaner workforce, they wrote. “We believe this weakness in urban demand is likely to persist,” Varma and Nandi wrote, explaining that the post-pandemic surge in pent-up demand has ebbed, monetary policy is tight and the central bank’s crackdown on unsecured credit harms activity.