Benchmark indices closed more than a percent higher on Wednesday, amid relief following the US presidential election results.

Despite global trade volatility, Donald Trump’s victory could lead to strong risk-on sentiment, driven by expectations of tax cuts and higher government spending, as well as a reversal in FPI flows, experts said.

-

Also read: Markets can turn if earnings growth is sub-par: Tata Asset Management CIO-Equities

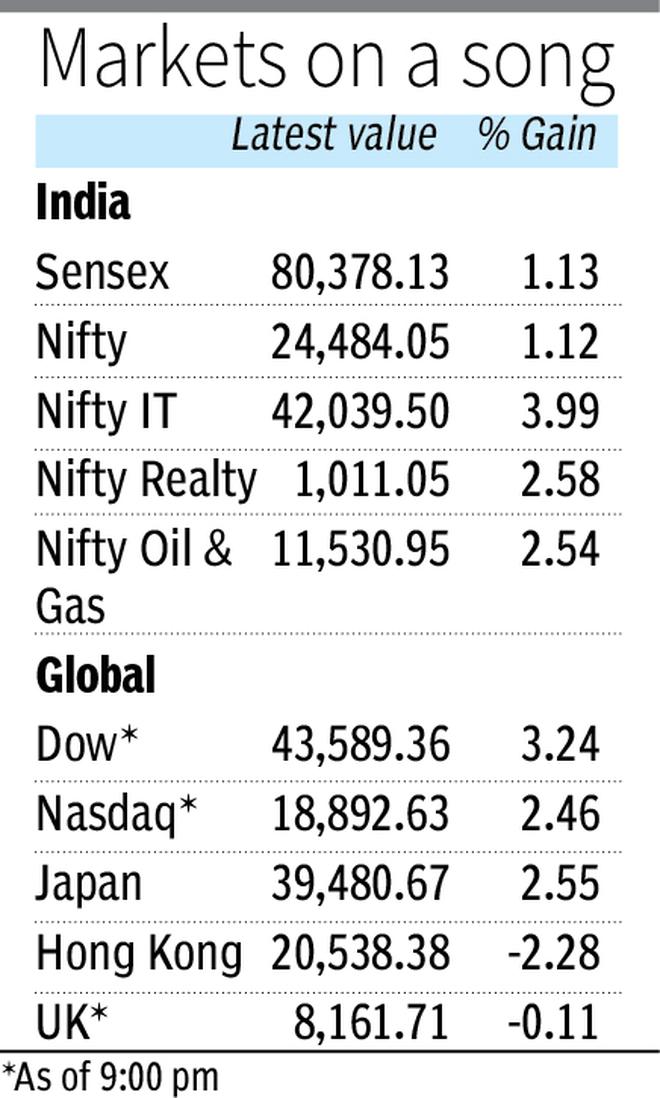

The Sensex ended higher by 901 points or 1.13 per cent at 80,378, while the Nifty ended at 24,484, up 1.12 per cent. The Nifty Midcap 100 Index and the Nifty Smallcap 100 rose more than 2 percent.

Sector gains

IT stocks rose in anticipation of a recovery in IT spending in the US. However, FPIs continued their selling streak and sold shares worth ₹4,445 crore.

“The recent FPI outflows appear to have been influenced by the Chinese economic stimulus measures in late September. A Trump presidency with prospects of high tariffs on Chinese goods has the potential to reverse the previous investment shift from India to China through FPIs,” said UR Bhat, director, Alphaniti Fintech.

Trideep Bhattacharya, President & CIO-Equities, Edelweiss MF said India could be a relative beneficiary among emerging markets as US companies pursue a ‘China +1’ strategy, bringing together sectors such as electronics manufacturing, chemicals and pharmaceuticals are likely to gain momentum.

-

Also read: Tesla shares are rising as Musk’s bet on Trump signals potential gains

Arindam Mandal, head of global equities at Marcellus Investment Managers, said select Indian exporters could benefit from a stronger US dollar.

Asian markets in Japan, Taiwan and Singapore also closed higher on Wednesday, with the Nikkei 225 rising more than 2.5 percent. The European indices recorded firmly in the green. Dow Jones Futures rose more than 3 percent.