Bluestone, the jeweler, has received board approval for its ₹1,000 crore IPO debut, which will include a mix of a new issue and an for-sale offering.

According to data from market intelligence platform Tofler, the company is estimated to have a valuation of around ₹12,000 to ₹13,000 crore.

Moreover, the d2c (direct-to-consumer) seller has approved a resolution to issue 13,00,000 shares to its founder and CEO, Gaurav Singh Kushwaha, to raise ₹75 crore.

-

Also read: Stricter supervision of SME IPOs is welcome

Kushwaha’s new investment aims to meet the minimum capital requirement for promoters as required by the Capital and Disclosure Requirements Regulations (ICDR).

Pre-IPO round

In September, the company had raised ₹900 crore in a pre-IPO round from Peak XV Partners, Prosus and Steadview Capital in August, positioning it in the unicorn category.

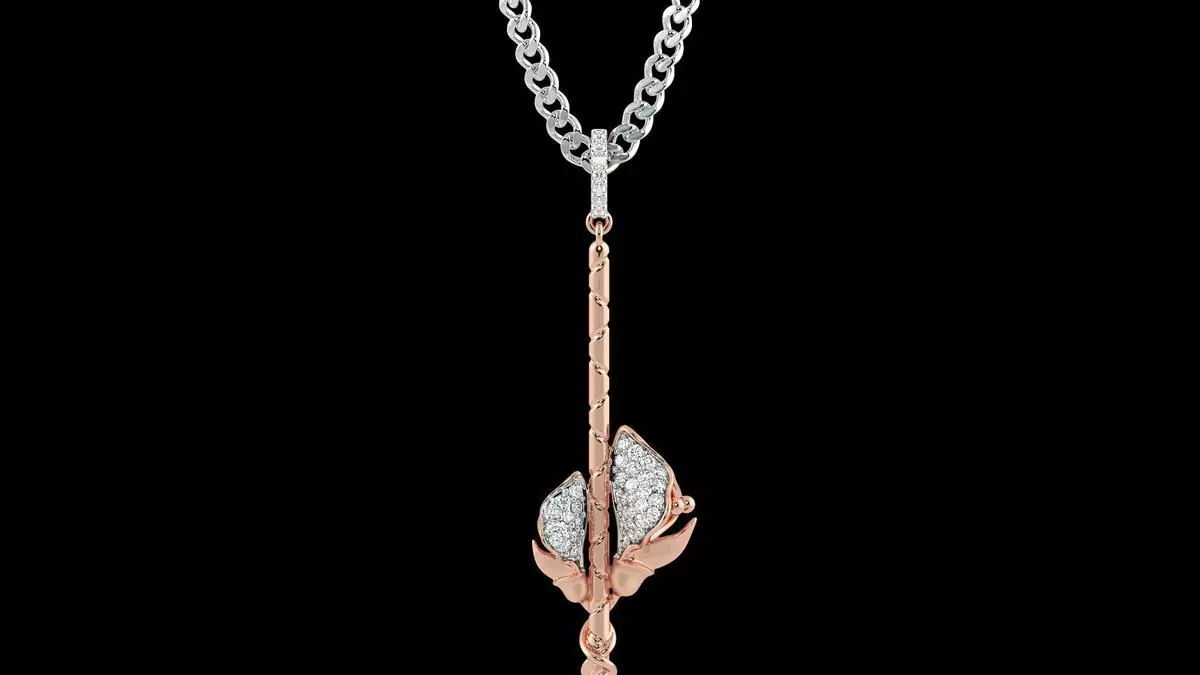

Founded in 2011 by Kushwaha and Vidya Nataraj, the start-up is a company that manufactures, designs and sells fine jewelery and has a presence in over 80 cities, with 192 stores.

The company reported revenues of ₹1,265.8 crore in FY24, compared to ₹770.7 crore in FY23. Bluestone also reduced its losses by 15 per cent year-on-year (yoy) to ₹142.2 crore in FY24, compared to ₹167.2 crore in FY23, Tofler data showed.