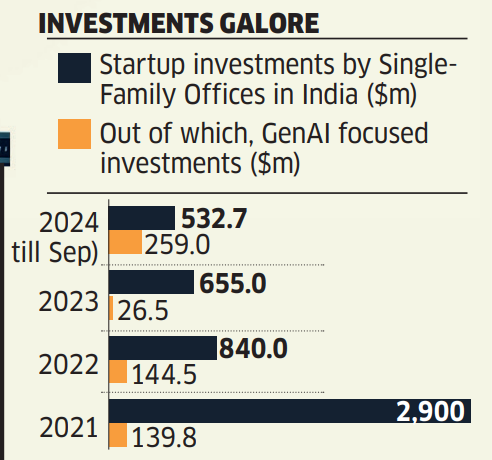

Venture capitalists and private equity firms aren’t the only ones betting on the GenAI race. Indian family offices also want a piece of this growth story and are quietly supporting AI startups in India and abroad. Between 2021 and September 2024, Indian family offices invested nearly $570 million in AI-focused companies, with such allocations increasing year on year, data sourced from market research firm Traxcn shows. This year alone through September, nearly $259 million has been pumped, exceeding investments in all previous years, signaling increased family office interest in the GenAI space. GenAI investments also constitute half of the total investments made by family offices in startups in India so far this year.

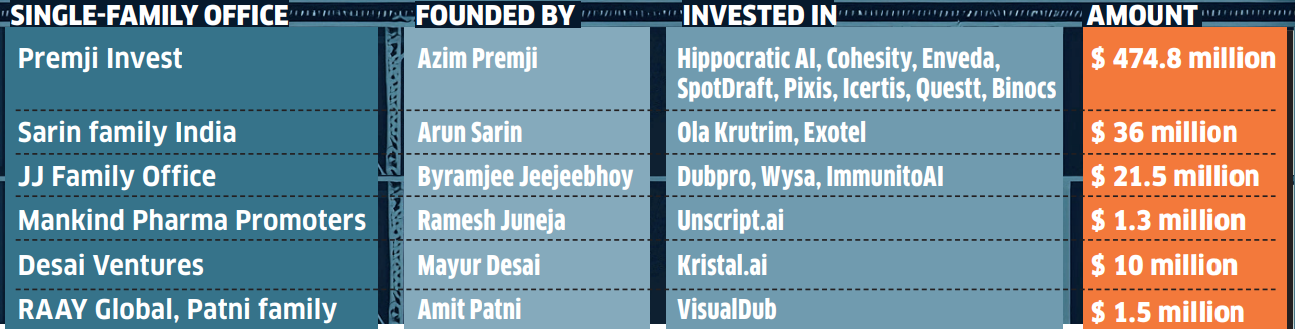

Among Indian family offices, Premji Invest, founded by veteran philanthropist and businessman Azim Premji, alone was responsible for three of the four major investments in AI by 2024, the last of which was Colorado-based Enveda. It is also reportedly in talks to invest in San Francisco-based AI startup Galileo.

It is leading the GenAI investment race by backing foreign companies such as Paris-based Hugging Face, California-based Hippocratic AI, Cohesity, Enveda, SpotDraft, Pixis and Icertis, to name a few. Back home, Premji Invest has pumped money into Gurgaon-based Questt and Bengaluru-based Binocs.

“At Premji Invest, we are evergreen capital and we are excited to back companies with the potential to build businesses that will last for generations, across India and the US, from Series A to pre-IPO,” said Manjot Pahwa, Head , early-stage technology investment, told ET.

The generative AI landscape in India will evolve differently than in the US, with huge opportunities in the vertical LLM (large language model) space where many Indian startups will emerge, she said, citing examples of portfolio companies such as Hippocratic AI, which are building from a vertical LLM in healthcare, and Poolside which is building a platform for software development.

The Premji family office has previously backed Indian startups such as Lenskart, PolicyBazaar and FirstCry, as well as global companies including Canva, Crowdstrike and Moderna.

Neha Singh, co-founder and CEO of Tracxn, said investments in GenAI globally have reached $59.2 billion, of which 63% occurred in 2023 alone. Five $1 billion funding rounds have been observed globally. Year to date, $18 billion in funding has been raised, up 10.4% from the same period in 2023. “The outlook for generative AI also remains positive for the Indian startup ecosystem despite being a emerging market for AI,” said Singh. She expects family offices will increasingly work “with venture capital funds globally to capitalize on venture capital funds because of their market expertise and broad portfolio to diversify their own investments.”

GV Sanjay Reddy, chairman of Reddy Ventures, a family office that backs tech disruptors like Cred, Hive, Upstox and KhataBook, believes that with GenAI, “the pace of change will be faster than we can imagine.”

Reddy, along with former BharatPe executive Ankur Jain and computer scientist Andrew Ng’s California-based AI Fund, in his first investment in India, recently co-founded AI-based healthcare platform Jivi. He said family offices are interested in being part of the growth story of AI startups.

“We are committed to investing in five AI-driven companies over the next five years, focusing on applications and outcomes that have the potential to transform industries and drive meaningful impact on a global scale,” Reddy said.

His family office has so far invested in more than 25 technology startups across the US, India, Africa and Southeast Asia. This follows the global trend among entrepreneurs and technocrats like Peter Thiel, Nat Friedman, Eric Schmidt and Naval Ravikant to back companies like OpenAI, DeepMind, Perplexity AI, Anthropic, etc. But these are late-stage investments, while closer to home, Indian families are. prone to early-stage pre-seed investments, experts say.

RAAY Investments, single-family office of top investor Amit Patni, invested $1.5 million in deep-tech SaaS startup Neural Garage, whose AI platform Visual Dub can translate OTT content, broadcasts and advertisements into multiple languages. “We are constantly looking for breakthrough ideas that will shape the future of how people consume things,” said Benaifer Malandkar, chief investment officer at RAAY Investments. “The fact that the total addressable market for this type of disruption is undefined right now – it excites us.” However, she added that family offices are cautious and focused with their investment philosophy and are keen to back startups that offer lucrative tech use cases. The Patni family has backed companies like Incred Finance and Bombay Shirt Company, among others.

Prateek Agarwal, managing director and CEO of Motilal Oswal Asset Management Company, said that unlike US investors who are making huge investments in AI computer hardware and model training, India is more inclined towards the application side of AI, Agarwal said. He also said that family offices either have a separate internal desk or invest together with PE firms based on their risk profile. “We see some large families co-investing with private equity, which helps them balance their risks,” Agarwal said.