Set up UPI for NRIs

NRIs must first link their international mobile numbers with their NRE or NRO bank accounts. This step is most important for enabling UPI or Unified Payments Interface transactions with their foreign numbers. Once linked, NRIs can download a UPI-compliant application that is compatible with international mobile numbers, such as iMobile or PhonePe.

After downloading the app, users must undergo an onboarding process, including verification of their mobile number. They will then need to create a unique UPI ID or Virtual Payment Address (VPA) linked to their international mobile number. Finally, they select their bank account and submit the details to activate their UPI profile.

View full image

Supported countries, banks and apps

NPCI has enabled UPI for NRIs living in specific countries including US, Canada, UK, UAE, Singapore, Australia and more. As for banks that enable UPI transactions, NRIs can access services from the list of specific banks. These include AU Small Finance Bank, Axis Bank, Canara Bank, City Union Bank, DBS Bank, Equitas Small Finance Bank, Federal Bank, HDFC Bank, ICICI Bank, IDFC First Bank, IndusInd Bank, Punjab National Bank and South Indian Bank. Each of these banks offers services to support NRIs in managing their finances through UPI.

Currently, UPI applications that allow NRIs to transact from their international numbers include BHIM AU (by AU Small Finance Bank), FedMobile (by Federal Bank), iMobile (by ICICI Bank), BHIM Indus Pay (by IndusInd Bank), SIB Mirror+ ( by South Indian Bank) and PhonePe. These apps ensure that NRIs can easily connect to their financial networks in India, regardless of their current location.

Also read: The NRI Guide to Choosing the Right Kind of Account to Invest in Indian Stocks

How NRIs can use UPI

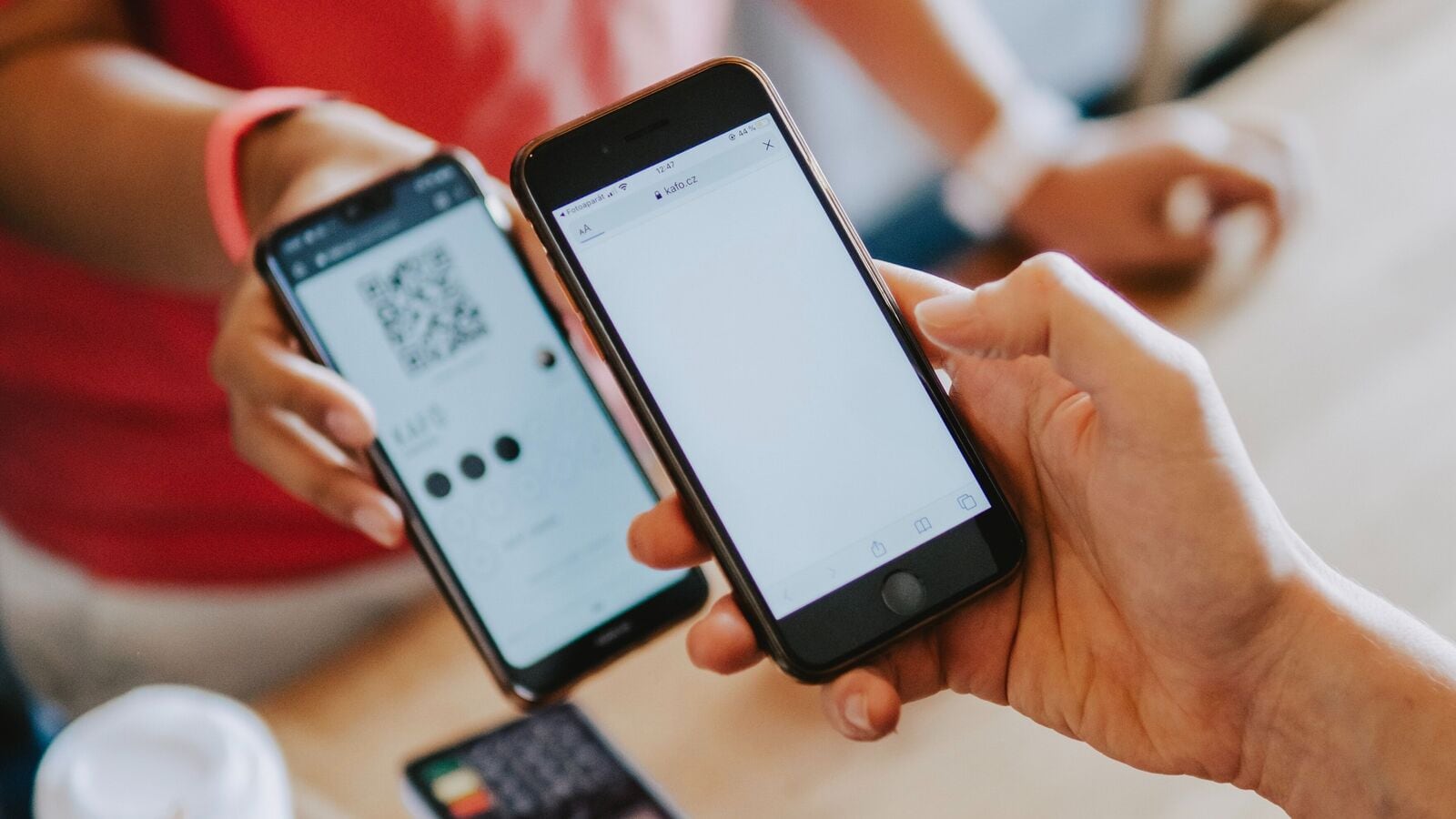

UPI allows NRIs to send money in Indian Rupees for various purposes such as paying Indian merchants, transferring to UPI IDs or by scanning Indian QR codes. NRIs can also send money to any Indian mobile number or bank account, provided it supports UPI. With UPI, transactions are processed instantly, so the recipient’s account is credited almost immediately upon completion.

Currently, UPI transactions are made in Indian Rupees (INR) only. When you initiate a successful UPI transaction, the money is credited to the beneficiary’s account almost immediately. However, payments to a contact can only be made to Indian mobile numbers, and this is only possible if the recipient has a valid UPI/VPA ID linked to an Indian bank account.

It is important for NRIs to remember that UPI transactions have certain daily limits. NPCI prescribes a maximum transaction limit of ₹1 lakh per day, although this may vary slightly from bank to bank. In case of newly registered UPI IDs, NRIs have an initial transaction limit of ₹5,000 for the first 24 hours, then the full daily limit will be restored.

Permitted transactions for NRIs

NRIs are allowed to conduct UPI transactions between NRE and NRO accounts as well as with resident Indian accounts. However, transfers from an NRO account to an NRE account are not permitted. Allowed transaction combinations include NRE to NRE, NRE to NRO, and both NRE and NRO to resident accounts. If an NRI has multiple bank accounts, each account must have a unique UPI ID as multiple accounts cannot be linked to a single UPI/VPA ID.

Even if an NRI is not registered with UPI, they can still receive money through the ‘send to account’ option in the UPI app. This option allows the sender to manually enter the recipient’s bank account information.

Considerations for joint account holder

For NRIs with joint accounts, UPI is limited to the primary account holder, who can generate one UPI ID and access it on only one device. This restriction ensures secure and controlled access, especially for joint accounts with multiple account holders.

Also read: The reintroduced indexation for real estate does not allow loss compensation, with the exception of NRIs

Convenient and cheap option

While UPI remains usable across borders, NRIs can transact even when traveling to India or other countries. When changing locations, re-registration with a local mobile number is not necessary. If NRIs encounter mobile connectivity issues, they can rely on Wi-Fi to make UPI payments even when international roaming is inactive.

According to the NPCI website, UPI transactions for NRIs are free, making it a cost-effective option for Indian Rupee payments. With the inclusion of NRIs, UPIs have become a convenient and cheap option to support families, complete routine transactions and be financially connected to India.

Also Read: Which is Better for SIPs: UPI AutoPay or eNACH?