NEW DELHI: The festive season has brought some cheer to the economy. Several data on Friday pointed to improved consumer confidence, but economists warned that growth faces headwinds on several fronts.

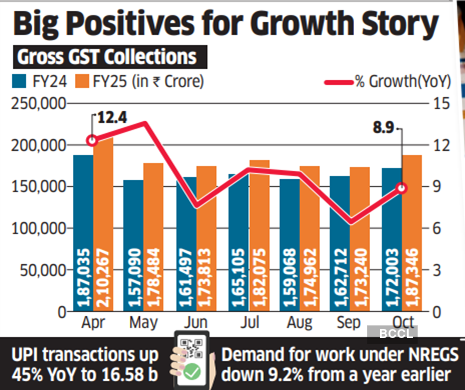

Goods and services tax (GST) collections recovered from a record low in September and posted a healthy 8.9% rise in October from a year earlier to Rs 1.87 lakh crore.

Several car companies such as Maruti Suzuki, Tata Motors, Mahindra & Mahindra and JSW MG Motor India reported record sales last month.

The Unified Payments Interface (UPI) handled 16.58 billion transactions as of October 2024, up 45% year-over-year. Demand for work under the government’s flagship rural employment program fell for the twelfth month in a row in October from a year earlier, falling 9.2% from a year earlier, indicating indicates that there are jobs available elsewhere in the economy.

“Contrary to the message from FMCG companies about weak urban spending, consumption on track, indicated by GST collections, is a consumption-based number,” said Madan Sabnavis, chief economist, Bank of Baroda. “Increasing collections is a positive signal, indicating that the Indian economy will grow by around 7%, assuming consumption and private investment revive.”

Finmin’s report

Data released on Wednesday showed India’s nuclear sector output rose 2% in September, compared with a 42-month low of 1.6% in August.

Sales of gasoline and jet fuel rose about 8% in October due to increased holiday travel, while sales of diesel – mainly used by long-distance commercial transport – stagnated, official data showed.

“We are hopeful that the bountiful monsoon will translate into healthy kharif cash flows, boosting rural demand during the festive season,” said ICRA chief economist Aditi Nayar.

The improved figures come amid concerns that the Indian economy may have slowed. In its September monthly economic report released last week, the Treasury said there has been “some weakening of momentum in manufacturing” while heavy monsoon rains affected mining and construction activities.

An ETIG analysis of the quarterly results of 175 companies in September showed that turnover and net profit rose by 7.2% and 2.5% respectively. Sales growth was the slowest in five quarters, while profit growth was at a six-quarter low.

OUTLOOK

The recovery in government spending and better agricultural prospects due to the good monsoon from June to September are also expected to support the economy.

Data released on Wednesday showed the Centre’s fiscal deficit in the first half of FY25 at 29.4% of the annual target, compared to 39.3% a year earlier.

“In the second half of the year, rural demand is expected to improve, driven by better agricultural production, and government expenditure is also expected to rise,” said Gaura Sen Gupta, chief economist at IDFC First Bank. On the other hand, the economy faces risks from still high food inflation, escalating geopolitical conflicts and loss of sentiment due to the sharp correction in stock markets.

Kotak Mahindra Bank chief economist Upasna Bhardwaj warned that growth in the second half of the fiscal is likely to be slower than that in the first half.

“Manufacturing sector activity is showing some signs of fatigue and car sales are also slowing,” Bhardwaj said. Still, “while there is an overall slowdown, this is not a worrying trend.”