Thanks to robust collection through new fund offerings and a steady market rally, the average assets under management of the country’s largest fund house, SBI Mutual Fund, rose 11 per cent to ₹10.99 lakh crore in the September quarter, up from ₹ 9.88 lakh crore in the June quarter.

In fact, SBI MF is the only fund house to have crossed the AUM mark of ₹10 lakh crore, and its assets were 30 per cent and 45 per cent higher than those of second and third-placed ICICI MF and HDFC MF at ₹ 8.41 lakh crore. (₹7.47 lakh crore) and ₹7.59 lakh crore (₹6.71 lakh crore), respectively.

Launched in August, the SBI Innovative Opportunities Fund currently has assets under management of ₹8,174 crore. The benchmark Sensex rose 7 percent to 84,300 points in September, up from 79,033 points in June.

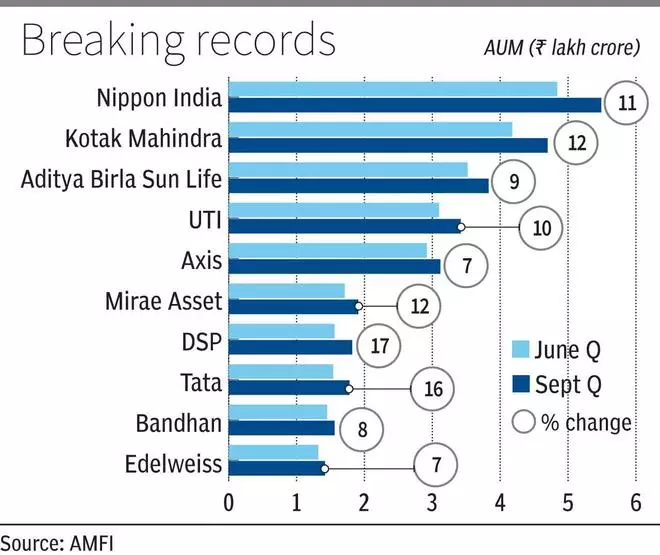

The sector’s assets under management rose 12 per cent to ₹66.22 lakh crore in the September quarter from ₹58.96 lakh crore in the June quarter.

Hitesh Thakkar, acting CEO of ITI Mutual Fund, said the domestic investment story is very encouraging and investors can now understand that short-term volatility is part of the long-term trajectory of wealth creation.

This is one of the reasons for the sharp increase in financial assets, within which MF’s share is gradually rising, he added.

Two fund houses – Franklin Templeton MF and Canara Robeco MF – have crossed the AUM mark of ₹1 lakh crore. Of the 40 active fund houses, 16 had assets under management of over ₹1 lakh crore at the end of September and have cumulative assets under management of ₹59.51 lakh crore, accounting for 90 per cent of the sector’s assets under management.

Funds raised through NFO in the September quarter rose 67 percent to ₹44,955 crore, compared to ₹26,899 crore in the June quarter. The number of NFOs launched increased to 60 from 35 in the June quarter.

Considering the resilience in the market, equity NFOs earned a whopping ₹34,675 crore last quarter alone, compared to ₹25,152 crore in the previous quarter.

Harish V, CEO of Smart Wealth Creators, a regional MF distributor, said the adoption of mutual funds as a vehicle for investing in the stock market through SIP is more pronounced in smaller cities after a very positive experience in the last three years.

However, he added that the recent stock market crash could impact the sentiment of novice investors who have not seen their asset values fall sharply.