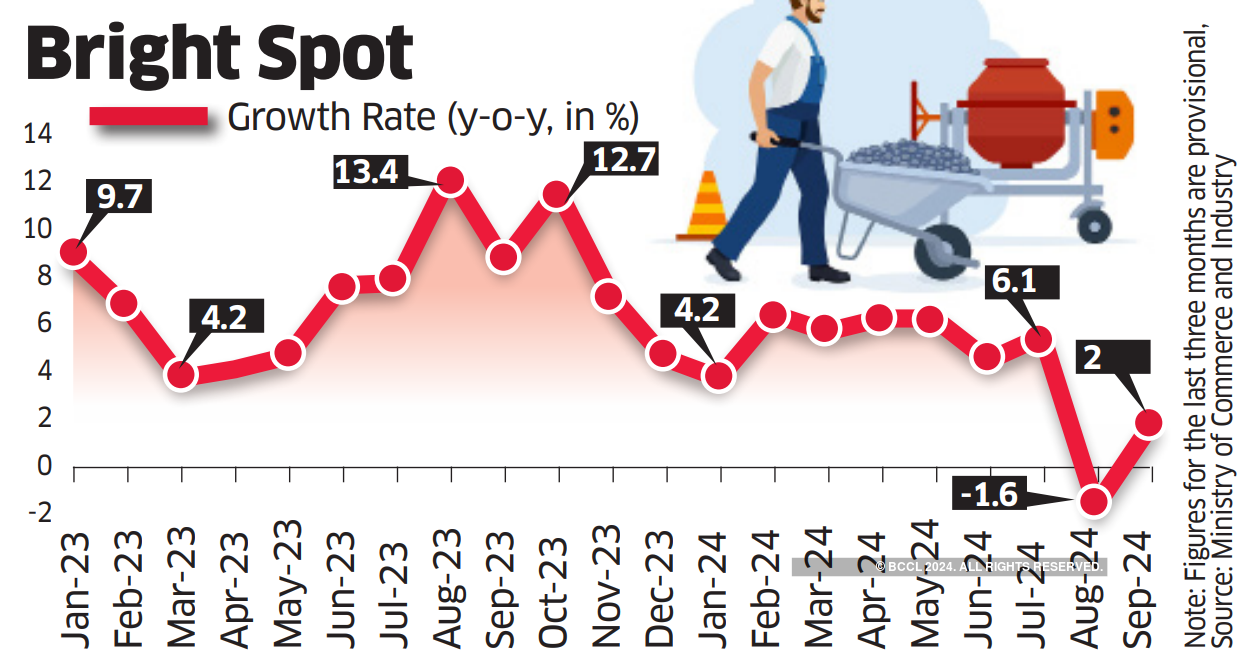

India’s nuclear sector output growth rose 2% in September, compared with a 42-month low of 1.6% the month before, according to official data released Wednesday.

Excluding August figures, September growth was the slowest in about two years.

Production was up 9.5% in September 2023.

“Mitigating disruption due to rainfall in sectors like mining and power has contributed to the turnaround in core sector performance (from August figures),” said Aditi Nayar, chief economist at ICRA.

The core sector includes eight industries: coal, crude oil, natural gas, refinery products, fertilizers, steel, cement and electricity. Five of these sectors grew in September.

According to data from the Ministry of Trade and Industry, performance in these sectors was lower at 4.2% in the first half of the current financial year, compared to 8.2% in the same period last year.

Cement recorded the fastest year-on-year growth in September at 7.1%. Refinery products were next at 5.8%, followed by coal (2.6%), fertilizer (1.9%) and steel (1.5%). In contrast, production of crude oil, natural gas and electricity fell by 3.9%, 1.3% and 0.5% respectively.

“Cement production growth improved from a contraction of 3.0% in August 2024 to a six-month high of 7.1% in September 2024, helped by a favorable fundamental. In contrast, steel production rose just 1.5% in the month, the slowest pace in 33 months,” Nayar noted.

Steel was the best performing sector in the first half of the current financial year, with growth of 6.1% compared to a year earlier. This was followed by electricity and coal (5.9% each), refinery products (2.3%) and natural gas (2%).

These eight sectors account for 40.27% of the weight in the Index of Industrial Production (IIP).

According to data released earlier this month, the IIP had shrunk by 0.1% in August for the first time in 22 months.

ICRA expects IIP to grow 3.5% in September due to reduced contraction in power and mining output, favorable base effect and significant increase in GST e-way bills supported by pre-festive supply, it said Nayar.