The Indian economy is likely to enter a cyclical slowdown and growth could fall below 6.7% due to emerging risks, Nomura economists opined, noting that weak urban demand is likely to remain paltry amid of high interest rates and moderating wage growth.

“Urban consumption indicators have been softening lately… We think this weakness in urban demand is likely to persist,” Nomura’s economists Sonal Varma and Aurodeep Nandi said in a note on Monday. They linked this to lower real salary increases, declining pent-up demand and tight credit conditions.

“We believe that the Indian economy has entered a cyclical slowdown. Coincident and leading growth indicators point to further moderation in GDP growth and the RBI’s forecast of 7.2% for 2024-25 is, in our view, overly optimistic,” they said. Nomura has forecast GDP growth of 6.7% this year and 6.8% in 2025-2026, but the note says downside risks to this forecast are increasing.

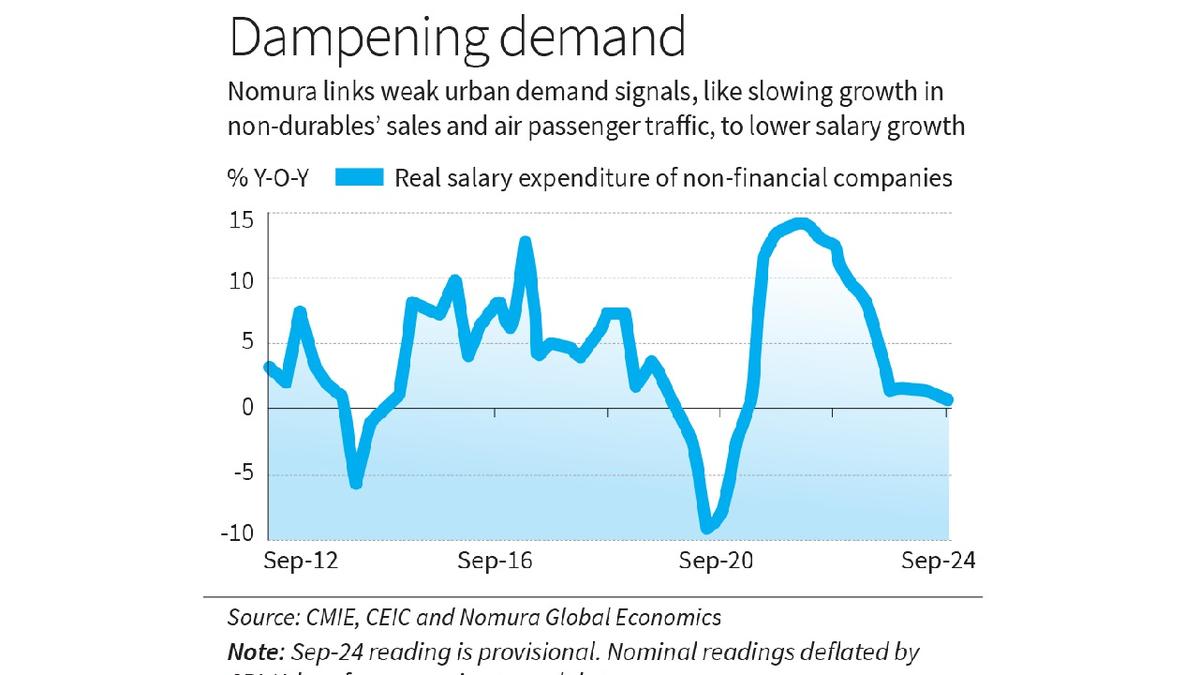

Companies are reducing their salary expenditure, the research note shows. “Deflated by urban inflation, growth in real salaries and wage expenditure of listed non-financial companies – a measure of urban real wages – moderated to 0.8% annualized in the second quarter of FY25, compared to 1.2% in Q1 FY25. down from 2.5% in FY24 and 10.8% in FY23. This likely reflects a mix of weaker nominal salary growth and a smaller workforce,” they concluded.

“Additionally, the post-pandemic surge in pent-up demand has waned, monetary policy is tight and the RBI’s macroprudential crackdown on unsecured, frothy credit is reflected in the slowdown in personal lending and non-bank lending growth financing companies.” the economists said, following an October 17 report that said “the growth glass looks half empty” for India.

Published – Oct 28, 2024 11:06 PM IST