The stock market recorded the biggest weekly fall in over two years with the NSE Nifty 50 down 4.77 per cent and the BSE Sensex down over 4 per cent for the week, marking the sharpest decline since June 2022. The sell-off intensified on Friday with the Sensex falling 1,176.46 points or 1.49 percent to close at 78,041.59, while the Nifty 50 ended 364.20 points or 1.52 percent lower at 23,587.50, marking the marks fifth consecutive session of losses due to concerns about delayed interest rate cuts by the US Federal Reserve.

The sectoral indices showed significant weakness with IT down 4.4 percent, Capital Goods down 5 percent and Energy down 5.2 percent. Only the real estate and pharmaceutical sectors showed some resilience, with the pharmaceutical sector posting a 2.3 percent gain this week.

The market decline was further exacerbated by the outflow of foreign investors. “The continued strength of the dollar against the rupee has prompted foreign investors to flee local equities and take refuge in dollar safe havens,” said Prashanth Tapse, Senior VP (Research) at Mehta Equities Ltd.

The outflow of FPIs continues

FIIs/FPIs recorded significant net outflows of ₹4,224.92 crore, while DIIs offset this with net inflows of ₹3,943.24 crore. Customers saw a net outflow of ₹376.23 crore, NRIs saw a marginal outflow of ₹1.43 crore, and proprietary traders recorded a modest net inflow of ₹326.87 crore.

The selloff was broad-based, with declines outweighing advances by almost three to one. Of the 4,085 stocks trading on the BSE, 2,950 fell, while only 1,045 advanced, and 90 remained unchanged. The market witnessed 229 stocks hitting their 52-week highs while 68 hit their 52-week lows.

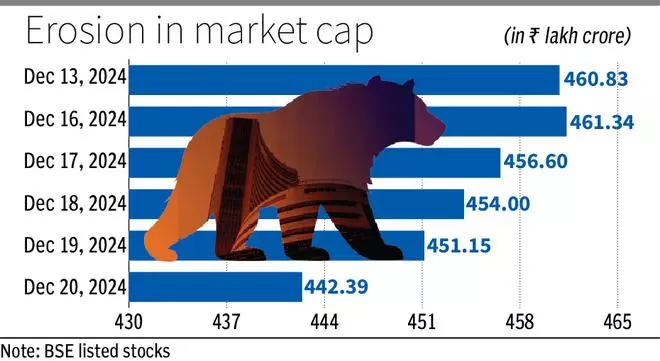

The stock markets saw significant market capitalization erosion today. The BSE All India market capitalization fell by ₹87,514.48 crore, falling to ₹44,239,094.65 crore from ₹45,114,609.13 crore on December 19. Moreover, the market capitalization of the top 10 companies fell by ₹1,39,034.32 crore, from ₹9,663,620.22 crore to ₹9,524,585.90 crore in the same period.

Technology and banking stocks led the decline, with Tech Mahindra emerging as the biggest loser, down 3.90 percent. Other big losers were Axis Bank (-3.51 percent), IndusInd Bank (-3.47 percent), Mahindra & Mahindra (-3.24 percent) and Trent (-2.99 percent). However, a select number of pharmaceutical companies have bucked the trend: Dr. Reddy’s Laboratories gained 1.49 percent, followed by JSW Steel (0.59 percent), ICICI Bank (0.40 percent), Nestle India (0.21 percent) and HDFC Life (0.03 percent). percent).

The broader markets suffered even steeper declines with the Nifty Next 50 down 2.72 percent to 68,702.65 and the Nifty Midcap Select down 2.64 percent to 12,683.15. The banking sector was also under significant pressure, with the Nifty Bank index falling 1.58 percent to 50,759.20.

“Disappointment with the US Fed’s slower than expected interest rate cuts has had a negative impact on sentiment in global markets. This bearish outlook mainly impacts the domestic market, which is already struggling with high valuations and low earnings growth,” said Vinod Nair, head of research at Geojit Financial Services.

Technical outlook

From a technical perspective, the market breach of key support levels has raised concerns. “Nifty has breached the SMA and EMA support of 200 days and closed on a weak wicket. The only support visible on the chart is the swing low of 23,263 made on November 28, 2024,” explains Nandish Shah, Senior Derivative & Technical Research Analyst at HDFC Securities.

Looking ahead, technical analysts point to continued caution. Amol Athawale of Kotak Securities indicates that as long as Nifty trades below the crucial 23,800 level, weakness could persist with potential downside targets of 23,400-23,200. However, a break above this level could trigger a relief rally towards 24,000-24,200. The Bank Nifty is facing a critical support at 50,500, with downside risk to 50,300-49,800 if it is broken. Market participants are also keeping a close eye on upcoming US economic data, particularly the Core Personal Consumption Expenditures index, while remaining cautious about the potential market impact of Trump’s trade policies expected in mid-January.

The market’s immediate focus remains on upcoming US economic data, particularly the Core Personal Consumption Expenditures index due later today, which could impact expectations for future rate cuts. Traders and investors are advised to exercise caution given current market dynamics and global economic uncertainties.