NRIs do not even benefit from indexation, which adjusts the purchase price according to inflation. Buyers must deduct taxes on the total sales value. However, buyers can apply for a lower TDS certificate to reduce this amount.

Moreover, NRIs often face challenges in managing the real estate remotely. Tasks such as approving repairs, managing maintenance costs, or renewing leases typically require property owners to be physically present. However, NRIs do have the option to appoint a Power of Attorney (PoA).

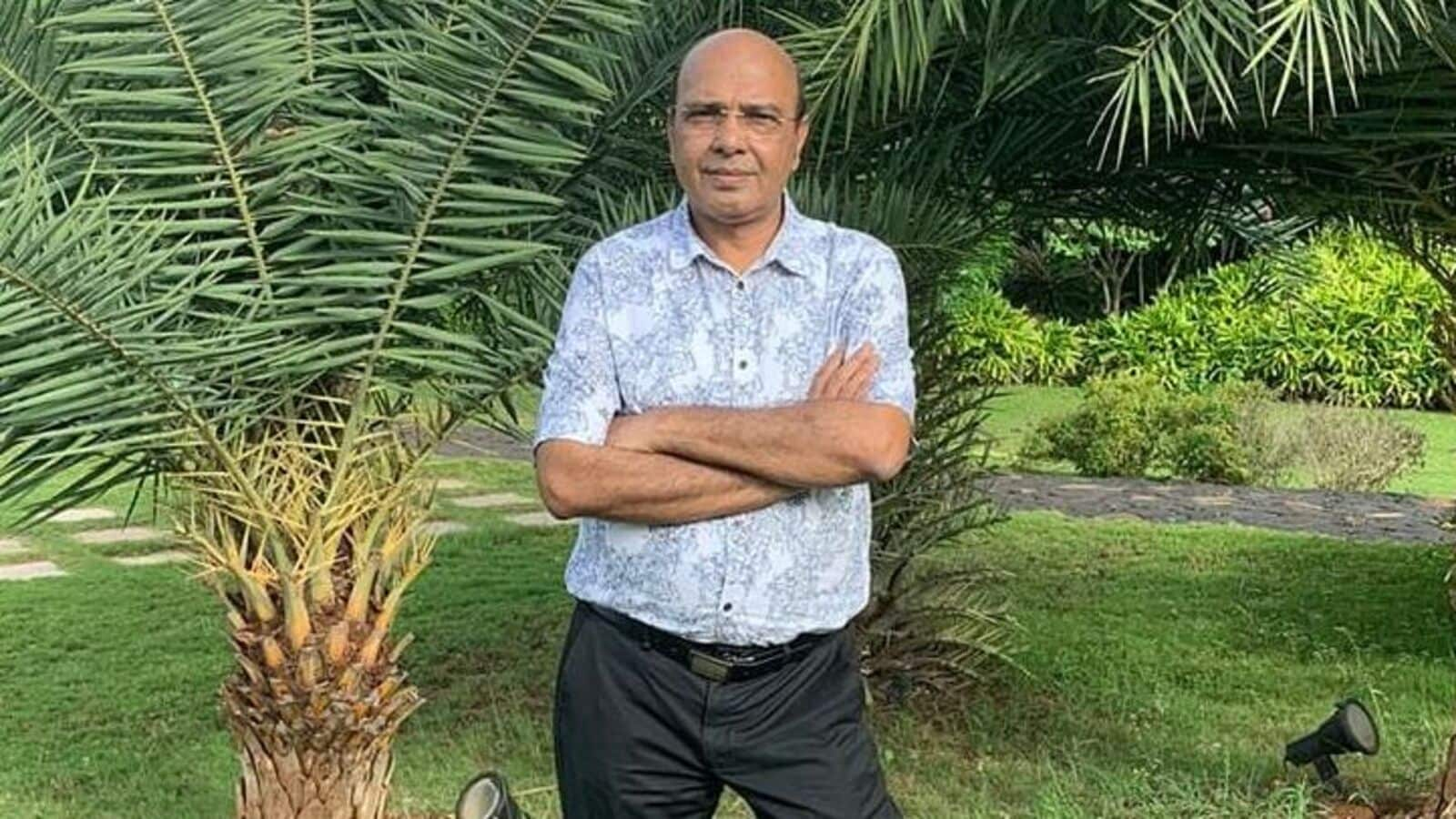

Mahesh Ahuja, a seasoned real estate agent with years of experience in the industry, shares Mint his views on why residential properties are not always the best investment choice for NRIs.

Why did you decide to stay on rent instead of buying a house?

As someone who has previously served in the Indian Navy, I have experienced the hassle of frequently changing homes due to transfers. I didn’t want to experience that again, so renting gives me the flexibility to move easily.

For most people, a home should be viewed as a consumer item rather than an investment. The appreciation for residential properties is often not as high as for commercial real estate, which is what I focused on.

My son is an NRI based in the US, and I have seen many NRI clients struggle with maintaining and transferring properties in India, especially when their children are based abroad and have no interest in the property. I didn’t want to create this kind of hassle for my own family.

However, I have found that the emotional and practical benefits of owning a home are often overemphasized, especially for people in my stage of life. At this age, I am more focused on ensuring financial security for my family through strategic investments, rather than tying up a large amount of capital in a home, which can be difficult to liquidate.

How and when did you start your real estate career?

I was in the Navy for about 13 years. I resigned for personal reasons. Just before I quit my job, I started looking for a house to buy. My first visit was to a property, where I met a real estate agent who presented the project to me.

Even though the agent was pretty good, I remember thinking I could do this job better. I was impressed with his sales pitch and personality, and I felt like I had the right skills to be successful in the real estate industry given my background in public speaking and training.

So when I quit my job, I decided to give real estate a shot in the early 2000s. Over the next few years, between 2003 and 2006, I ended up selling about 20 to 25 of my own properties, making good money.

Why did you sell all your real estate assets?

By 2006, I had built up a decent real estate portfolio, but I began to worry about market conditions and the sustainability of the rapid appreciation we had seen.

I had some challenges with clients when it came to selling their properties. I had to sell my own property to return the money to investors as there were disputes over payment terms and transfer processes. Moreover, I personally did not feel like having my own house, as I had already mentioned the hassle that comes with it.

Ultimately, in 2006, I made the conscious decision to sell all my residential real estate holdings, given the hassle involved in transferring the property to my son.

What challenges do you see NRI families facing with properties in India?

Ensuring that the property is properly maintained and cared for can be a constant headache for NRI owners, especially if they are not physically present. Finding reliable tenants, collecting rent and solving any problems can be a logistical nightmare from abroad. When the parents die, the process of transferring property to the children can be extremely tedious and complicated, especially if the children are not interested.

Why can’t real estate be a good investment for NRIs?

As an NRI, any real estate investment I make in India would be subject to the risk of the Indian rupee depreciating against the foreign currency I earn. The rupee has depreciated by almost 50% in the last two decades. This can significantly erode the true return on investment. Rental yields for residential properties in India are often quite low, sometimes between 2 and 3%. This makes it difficult to generate meaningful passive income from the investment.

In addition, there are significant transaction costs associated with buying and selling property in India, such as stamp duty, registration fees and estate agent fees, which together amount to approximately 12% of the property at the time of purchase, and capital gains tax on sale. . When it comes time to sell the property and repatriate the money back to my home country, there may be complex tax and legal hurdles to overcome. These can eat up the total return.

The returns often don’t justify the hassle and risks for NRIs. For NRIs, I have found that the potential benefits of owning real estate in India are often outweighed by the downsides: currency risk, low interest rates, high transaction costs and repatriation issues.

Unless an NRI has a very strong emotional or personal connection to a property in India, I think this is generally not the best use of their capital. The money is often better invested in more liquid assets, such as fixed deposits, which will give you more or less the same returns without any hassle.

How can NRIs tackle the challenges surrounding succession and ownership transfer?

Considering the complexities involved, it is important that NRIs plan ahead and take proactive steps to facilitate a smooth transfer of properties. Here are some key things I would recommend|:

Drafting a clear and legally binding will is crucial. This ensures that the property is transferred according to your wishes, rather than leaving it to chance or family disputes.

Appoint a close relative or friend living in India as a candidate or proxy. This person can take on daily management. Keep all property-related documents, such as the bill of sale, up to date and easily accessible. This will streamline the transfer process when the time comes.

Gifting the property to your children while you are still alive can be another way to make the transition smoother. I have personally decided not to own properties in India. Instead, I have focused my investments on more liquid commercial real estate.

What is your message to elderly parents who own properties with NRI children abroad?

I have seen this scenario happen quite often and have come to the conclusion that it is generally not advisable for older parents in this situation to own property in India. When the children settle abroad, they often have little to no interest in real estate in India. It becomes more of a burden than an asset for them.

Ensuring that the property is properly maintained and managed can be a constant headache for elderly parents, especially if they are not physically present in India.

My suggestion would be to seriously consider selling the property and investing the proceeds in more liquid, easily managed assets. This could be in the form of FDs, mutual funds, or even gifting the money to the children for their own use.

What is your suggestion for young investors today?

Approach real estate investments with a highly strategic and pragmatic attitude. These are the main points I want to emphasize. If you want to invest in real estate, focus on commercial properties, especially well-located retail properties, rather than residential properties. Commercial real estate tends to be valued much higher and offer better rental yields. Be very selective about the properties you invest in.

Treat a home as a consumer item and not as an investment. When you buy a house to live in, assume that the price of the property is essentially zero. Prioritize your own comfort and needs over investment returns when it comes to your primary residence. Look for reputable real estate advisors with a proven track record.

Diversify your investments across different asset classes. Ask professional advice.

Are you still active as a real estate agent?

Yes, after 2006 I consciously avoided investing in housing for myself. My focus has been on commercial real estate, which I believe offers better returns and fewer headaches.

As a real estate agent I remain very active in the market. I participate in the real estate industry through my real estate business rather than owning properties directly.

It is a decision that has served me well in recent years and fits in with my overall investment philosophy.