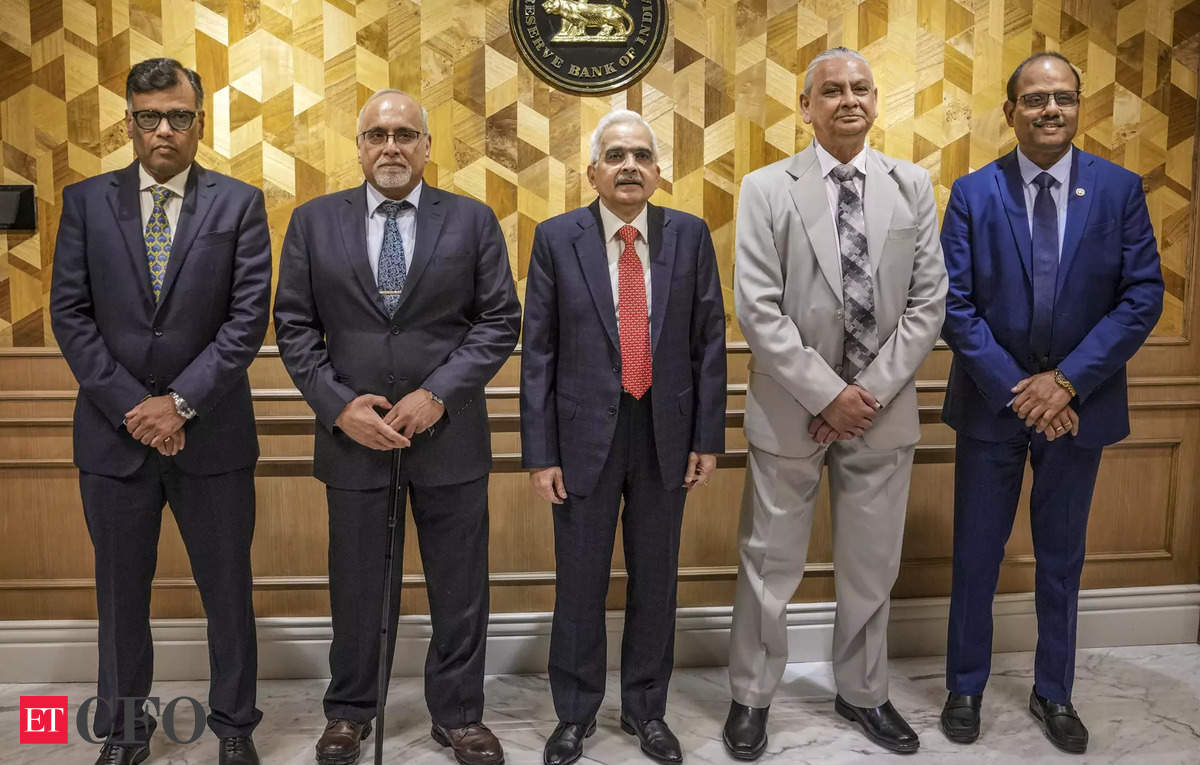

Mumbai: Reserve Bank Of India (RBI) Governor Shaktikanta Das, centre, and Deputy Governors T Rabi Sankar, left, M Rajeshwar Rao, second from left, Michael Debabrata Patra, second from right, and Swaminathan Janakiraman, right, for a press conference at the company’s headquarters in Mumbai. (PTI Photo/Shashank Parade)

Mumbai: Reserve Bank Of India (RBI) Governor Shaktikanta Das, centre, and Deputy Governors T Rabi Sankar, left, M Rajeshwar Rao, second from left, Michael Debabrata Patra, second from right, and Swaminathan Janakiraman, right, for a press conference at the company’s headquarters in Mumbai. (PTI Photo/Shashank Parade) Mumbai Reserve Bank Governor Shaktikanta Das on Friday expressed confidence that growth in the second half of the fiscal would be much better than the April-September period, even as the central bank significantly cut its FY25 growth projection to 6.6 percent. The downward revision to growth forecasts follows the 5.4 percent GDP print in the second quarter, the lowest in the past seven quarters. Growth was also below the 6.7 percent recorded in the first quarter (April-June). India recorded a growth of 6 percent in the first half (April-September) of the current fiscal.

RBI lowered its growth forecast for the current fiscal year to 6.6 percent from 7.2 percent previously expected.

Going forward, Das looks better than the first half of the current fiscal year.

The better projection for the second half is based on healthy Kharif crop production, higher reservoir levels and better rabi sowing.

Moreover, industrial activity is expected to normalize and recover from the lows of the previous quarter. Mining and electricity are also expected to normalize after the monsoon-related disruptions.

As far as inflation is concerned, Das said, it must be reduced in the interest of sustainable growth.

“The horse (inflation) has made a valiant attempt to run away, our attempt is to keep it on a tight leash… there is no room for knee-jerk reactions. We need more evidence before taking any action and the action is to be on time,” he said in an interaction with the media.

The Monetary Policy Committee remains committed to restoring the balance between inflation and growth, which have been disrupted recently, he said, adding that the RBI will use its various policy tools to create conditions for restoring the inflation growth equilibrium.